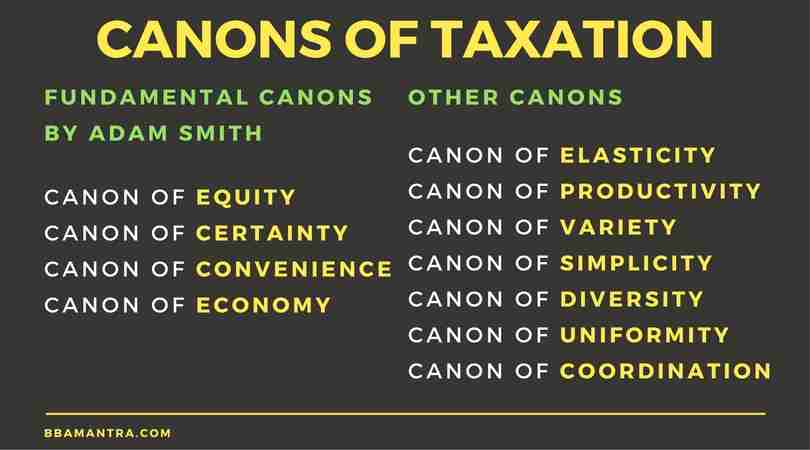

Canons of Taxation are the fundamental principles of taxation which are used to create an effective taxation system in a country. Canons are basically characteristics of a good taxation system. A government must incorporate these canons of taxation when developing a tax structure & system in order to make the same more efficient and effective.

Fundamental Canons of Taxation

The four fundamental canons of taxation were propounded by Adam Smith in 1776. They were:

Canon of Equity – Every person must pay taxes in proportion to his income. But modern economists support progressive taxation, i.e. more the income more the tax burden.

Canon of Certainty – It states that the tax that is to be paid by a person must be certain and not arbitrary. The tax payer must know in advance –

- How much tax to pay?

- When to pay?

- In what form to pay? (manner of payment)

- How to pay?

Canon of convenience – It states that tax must be levied in such a manner and at such a time that it is convenient to the tax payer as he makes a sacrifice at the time of tax payment.

Canon of Economy – The cost of tax collection should be minimum and the taxes collected must bring maximum revenue to the Government.

Others Canons of Taxation

Canon of Elasticity – Taxes must be elastic in nature i.e. Government must be able to increase or decrease the tax revenue according to the requirements of the country.

Canon of Productivity – A tax must be able to yield sufficient revenue to the government otherwise it will be a unproductive tax. Therefore, few productive taxes are better than imposing many unproductive taxes.

Canon of Variety – A single tax can be easily evaded by a person. Therefore there must be a variety of taxes on people and commodities.

Canon of Simplicity – A tax system must not be complex. It must be simple so that every tax payer can understand it without any special assistance.

Canon of Diversity – It states the principle of multiple taxation (charging various direct and indirect taxes rather than one single tax) so that all sections of the society can be brought under the taxation network. But too much diversity in taxes is undesirable as it increases the cost of tax collection.

Canon of Uniformity – It refers to uniformity in imposition of tax, assessment of tax and realization of tax.

Canon of Expediency or Desirability – A tax must be desirable. A tax payer must be given justification as to why he is paying a particular tax.

Canon of Coordination – It states that tax authorities must be well coordinated.

Pls upload canon of coordination full topic