Merchant banking refers to the combination of banking and consultancy.

Merchant Banking involves the provision of banking services and consultancy to its customers regarding financial, marketing, managerial, and legal services. Consultancy denotes providing advice, guidance, and service for remuneration. It involves the provision of a wide range of services that help businesses from its inception to successful operations to winding up the business.

A merchant bank is an organization that underwrites securities for corporations advises such clients on mergers and is involved in the ownership of commercial ventures.

Merchant banker is defined as a person who is engaged in the business of issue management either by making arrangements regarding buying and selling securities or acting as a management consultant, advisor in relation to such issue management.

Merchant banking services help individuals and businesses in the following ways –

- It helps an individual to start a new business.

- It helps businesses to raise finance

- It helps businesses to modernize, expand and restructure their business

- It helps in revival sick business units

- It also helps companies to register, buy and sell shares at the stock exchange

Merchant banking is a type of banking where both commercial banks and investment banks can participate. It is involved in trading of unregistered securities including stock, bonds, and private equities.

Significance of Merchant Banking

The reason for the very existence of merchant banking is illustrated by the need for specialized investment information and services. An experienced merchant banker knows exactly where strategic assets are located, and which organizations and strategies to ward off. With a merchant banker, a businessman enjoys the benefit of hiring a skilled and knowledgeable partner with a long-term commitment to the business. The real benefit here is that a merchant bank helps to lower the risks for a new firm.

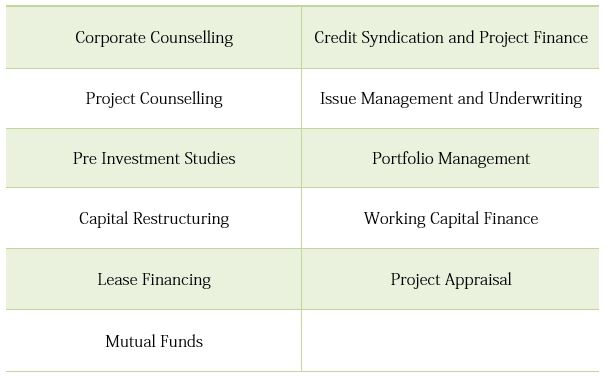

Functions of the Merchant Bank

Corporate Counselling

- Provide guidance in diversification

- Undertaking evaluation of product lines

- Rejuvenation of old companies

- Evaluation of revival prospects

Project Counselling

- Undertaking the general evaluation of projects

- Providing advice on procedures

- Conducting technical feasibility

- Assisting in technical feasibility

- Identification of potential investment avenues

Pre-investment Studies

- Carrying out detailed environmental studies and feasibility studies

- Assisting the client in shortlisting projects with greater return

Capital Restructuring

- Evaluating the capital structure of clients

- Preparing comprehensive memorandum related to Capital issues

- Suggesting alternative capital structures

Credit Syndication

- Estimating the total cost of projects

- Drawing up financial plans

- Preparing loan plans for financial assistance

Issue Management and Underwriting

- Creation of an action plan

- Creation of budget

- Drafting of prospects

Portfolio Management

- Undertaking investments in securities

- Undertaking a review of the portfolio

- Carrying out a critical evaluation of the investment portfolio

Working Capital Finance

- Assessment of working capital

- Providing advice on the issue of debentures

Acceptance Credit and Bill discounting

- Acceptance and the discounting of bills of exchange

Mergers, Amalgamations, and Takeovers

- Identifying organizations with similar characteristics

- Undertaking management audit

- Obtaining approvals from shareholders

Venture Capital

- Financing high risk yet high return projects

Lease Financing

- Providing guidance on the feasibility of leasing as a substitute source for financing capital investment projects.

- Providing guidance on the choice of a favourable rental structure.

Foreign Currency Finance

- Evaluation and assistance in carrying out a study of turnkey projects

- Guiding for exchange risk

- Assisting in operating international bank accounts

Fixed Deposit Broking

- Assisting the company to observe and maintain all rules

- Making arrangement for payment of loans

- Drafting of advertisements for inviting deposits

Mutual Funds

- Collecting public savings

- Investing in a diversified portfolio

- Earning for the investor a steady flow if returns

Relief to Sick Industries

- Rejuvenating old and sick firms

- Creating rehabilitation packages

- Exploring merger and acquisition opportunities

Project Appraisal

- The evaluation of industrial projects on the basis of technology, cost, capacity, etc.

With a merchant banker, a businessman enjoys the benefit of hiring a skilled and knowledgeable partner with a long-term commitment to the business.

I need to join