In this article we will have a look at the different banking instruments which help us in our banking transactions:

- Pay-in-Slip

- Cheque Book

- Pass Book

- ATM cum Debit Card

- Credit Card

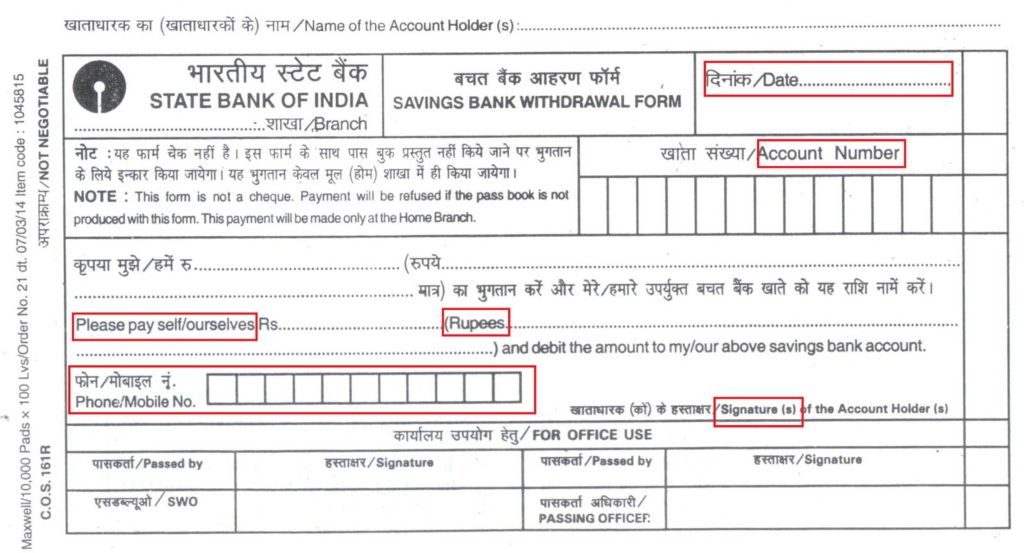

Pay-in-Slip

It is a blank document that has to be filled by the customer whilst depositing Cash or a cheque. The longer part of the pay-in-slip is called the counterfoil. The shorter part is to be kept with the depositor as the proof of deposit.

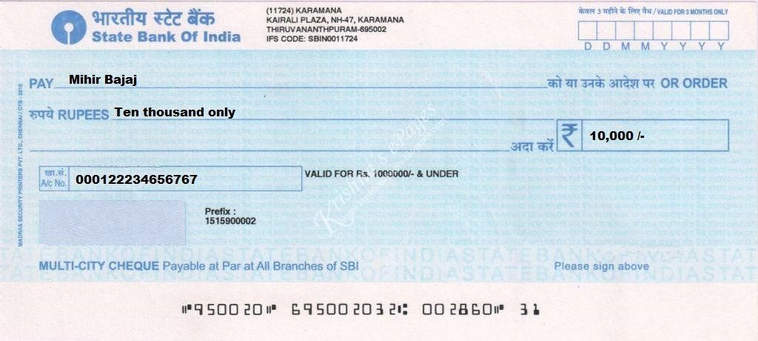

Cheque Book

It is a book of cheque which is used to either make a payment or a deposit.

“Cheque is an instrument in writing containing an unconditional order, addressed to a banker, signed by the person who has deposited money with the banker, requiring him to pay on demand a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.”

The Negotiable Instruments Act, 1881 defines a cheque as: “a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand.”

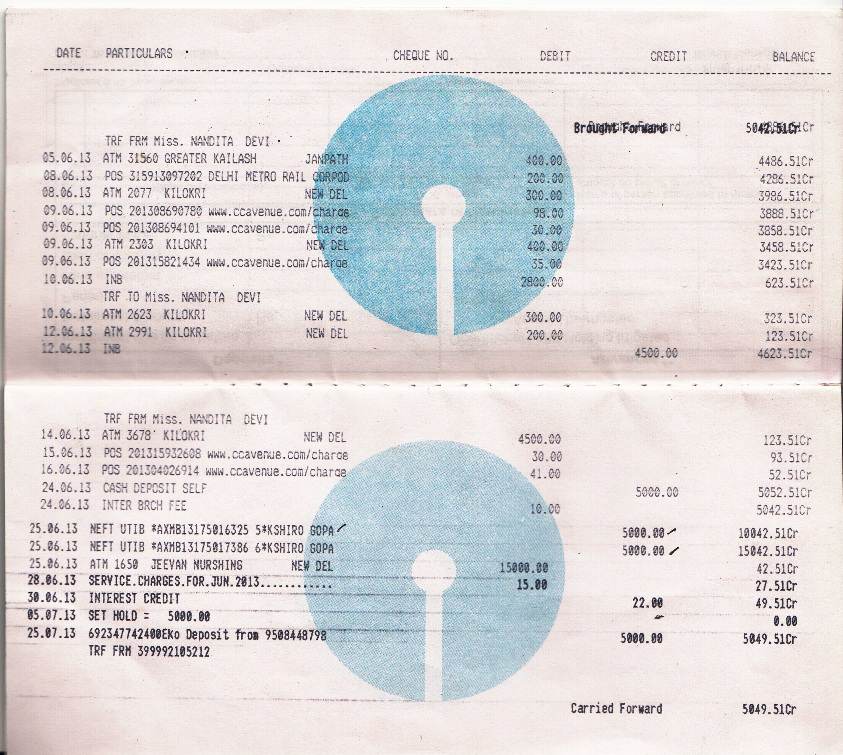

Passbook

A Passbook is a book provided by the bank which helps a customer to keep a record of all his banking transactions. This book has to be updated regularly. It consists of all the transaction history related to a particular account. The first page of the passbook has the credentials of the account holder, as provided by the bank.

ATM cum Debit Card

With greater mobility, ease of banking too has increased manifold. Now, we do not always have to visit a bank to withdraw or deposit money. This can be through ATM kiosks. ATM or Automatic Teller Machine, are cash vending machines. They dispense cash in selected denominations. Some ATMs may even dispense coins.

Most banks have also installed ATMs that can allow the user to deposit cash and a cheque. An ATM is accessed by an ATM cum Debit Card. This ATM cum Debit card is a card that will not only allow cash withdrawal or deposit at an ATM kiosk but also allow the user to make payments, either through online payment gateways or at retail counters. These cards are a handy appendage since it reduces the need to carry cash.

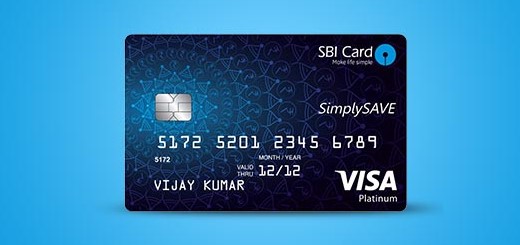

Credit Card

A Credit Card is similar to a debit card but with a major difference. A debit card works on the principle of a direct debit from the account, only when there is cash available in the account.

A credit card, as the name suggests, works on the principle of credit. That is, you can buy now and pay later. Credit card companies levy an annual charge. They also do levy penalties in case of late payment of outstanding balances.

One can think credit card payments to be short term loans. Here, you pay using the credit card issuer’s money and then pay him back with an interest added. Since credit card activities are reported to the credit bureaus, it is imperative for the owner of the card to use it responsibly. Also, responsible credit card usage can lead to a good credit score.