Presentation/Project/Slides Transcript

Topic: Dupont Analysis

Dupont analysis also Dupont model is a financial ratio based on return on equity ratio that is used to analyze a company’s ability to increase its return on equity.

It breaks down the return on equity ratio to explain how companies can increase their return for investors.

The Dupont analysis looks at three main components of the ROE ratio.

- Profit Margin

- Total Asset Turnover

- Financial Leverage

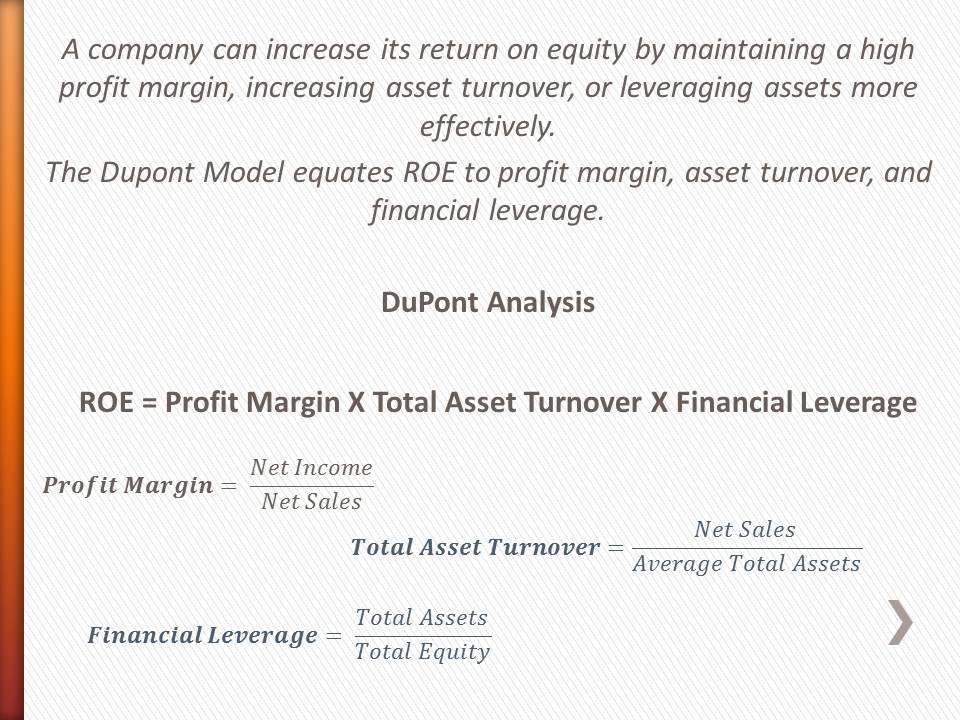

A company can increase its return on equity by maintaining a high profit margin, increasing asset turnover, or leveraging assets more effectively.

The Dupont Model equates ROE to profit margin, asset turnover, and financial leverage.

DuPont Analysis

ROE = Profit Margin X Total Asset Turnover X Financial Leverage

Analysis

Dupont Analysis was developed to analyze the ROE and the effects that different business performance measures have on this ratio. The objective is to analyze the variable causing the current ROE. For instance, if investors are unsatisfied with a low ROE, the management can use this formula to pinpoint the problem area whether it is a lower profit margin, asset turnover, or poor financial leveraging.

Once the problem is determined, management can attempt to correct deviations.

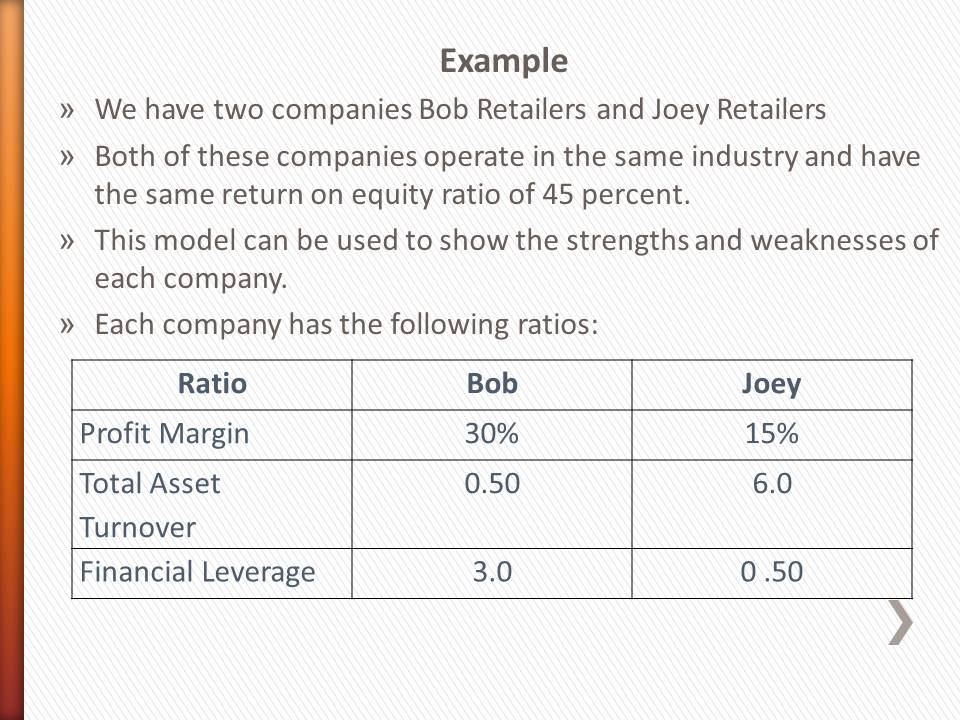

Example

- We have two companies Bob Retailers and Joey Retailers

- Both of these companies operate in the same industry and have the same return on equity ratio of 45 percent.

- This model can be used to show the strengths and weaknesses of each company.

- Each company has the following ratios:

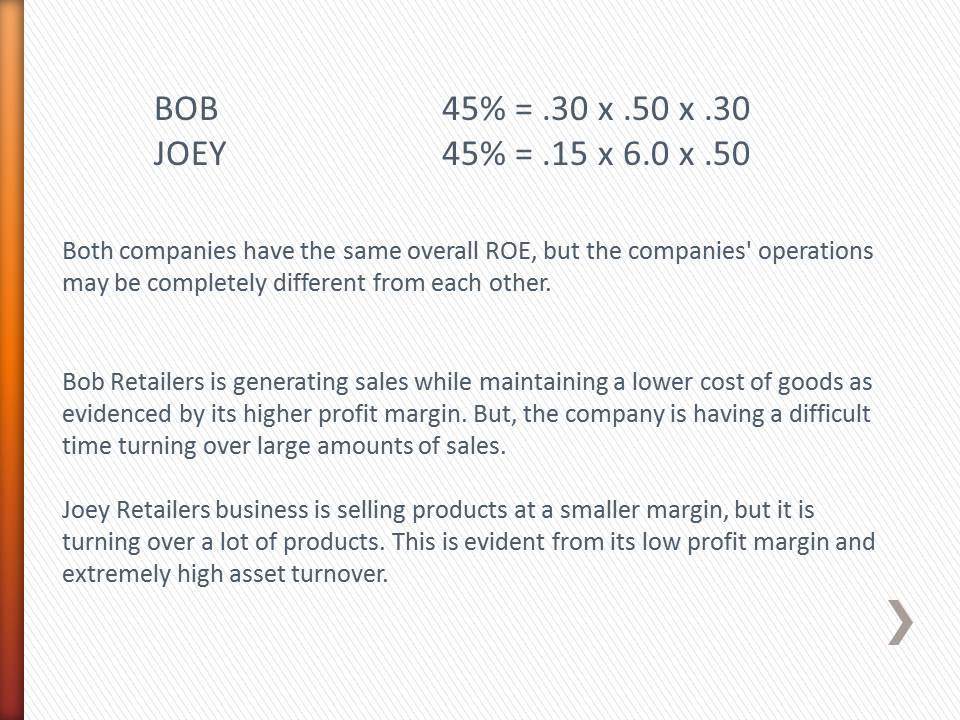

BOB 45% = .30 x .50 x .30

JOEY 45% = .15 x 6.0 x .50

Both companies have the same overall ROE, but the companies’ operations may be completely different from each other.

Bob Retailers is generating sales while maintaining a lower cost of goods as evidenced by its higher profit margin. But, the company is having a difficult time turning over large amounts of sales.

Joey Retailers business is selling products at a smaller margin, but it is turning over a lot of products. This is evident from its low profit margin and extremely high asset turnover.

This model helps investors to compare similar companies like these with similar ratios. Investors can then evaluate perceived risks with each company’s business model.

Have you tried NooIQ? It changed my life. https://NooIQ.co