Project/Slides/Presentation Transcript

Topic: Banking System of Canada

INTRODUCTION

The Banking System of Canada is the most efficient and safest banking system in the world. Canadian banks were handed a score between 1.0 (insolvent and possibly requiring a government bailout) and 6.8 on 7.0 (healthy, with sound balance sheets) Highest number of ABMs per capita in the world Banks provide financing to some 1.6 million small and medium-sized businesses.

HISTORY

- Banking operations started with the founding of Bank of Montreal in 1817.

- Official Canadian currency took the form of the Canadian dollar in 1871, overriding the currency of individual banks. Bank of Canada was established in 1935.

- 1980s-1990s-The largest banks acquired almost all significant trust and brokerage companies in Canada.

- Started their own mutual fund and insurance businesses.

- Canadian banks turned into international expansion, particularly in U.S.

TOP 5 CANADIAN BANKS

- Royal Bank of Canada-1864

- Toronto Dominion Bank-1955

- Bank of Nova Scotia-1832

- Bank of Montreal-1817

- Canadian Imperial Bank of Commerce-1961

Slide 6 – Banking System in Canada

Big Five is the name colloquially given to the five largest banks that dominate the banking industry of Canada. The five banks are operationally headquartered in Toronto, Ontario. Dominate the worlds ten strongest $100billion asset banks

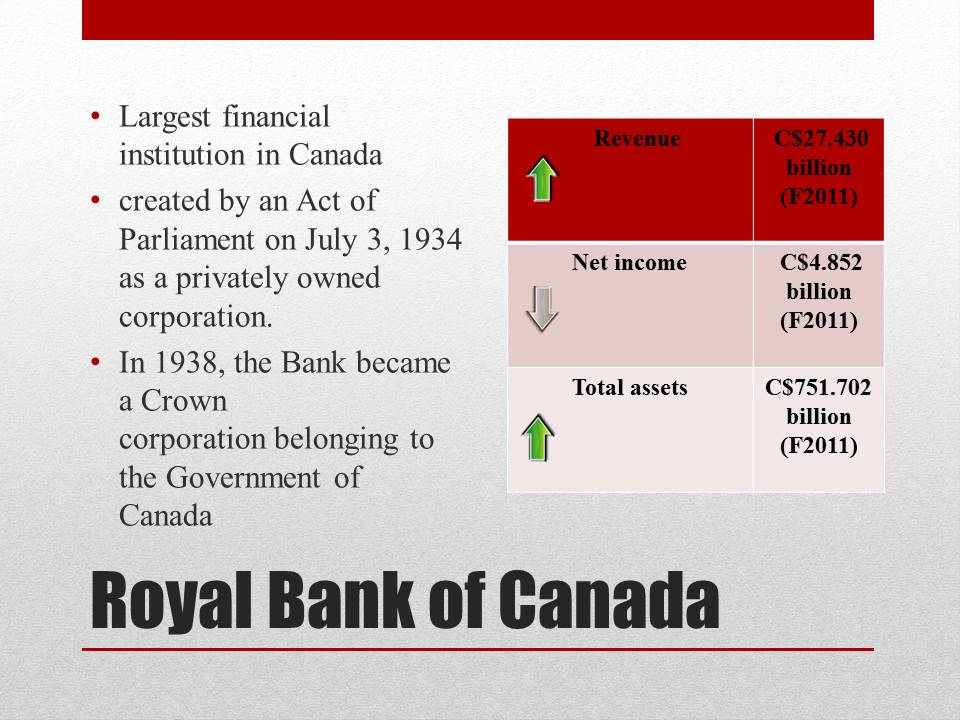

- Largest financial institution in Canada

- created by an Act of Parliament on July 3, 1934 as a privately owned corporation. In 1938, the Bank became a Crown corporation belonging to the Government of Canada

- Revenue C$27.430 billion (F2011)

- Net income C$4.852 billion (F2011)

- Total assets C$751.702 billion (F2011)

- “to promote the economic and financial welfare of Canada“

- influences interest rates through the setting of short-term rates

- Maintain the rate of inflation between 1%-3%

- Bank intervenes in the foreign exchange market only under exceptional circumstances

ROYAL BANK OF CANADA- INTERNAL STRUCTURE

Governor→Governing Council→Board of Directors

ROYAL BANK OF CANADA- EXTERNAL STRUCTURE

- The Bank’s mandate to “regulate and protect the national currency“

- Canadian Payments Association- an officer of the bank is the chairperson of the BOD

- Business Development Bank of Canada Originally a subsidiary of the BOC, it now exists more independently

- Canadian Deposit Insurance Corporation : Governor of the Bank of Canada sits on the CDIC’s Board of Directors.

BANKING STRUCTURE

- Schedule 1-Domestic banks(23)

- Schedule 2-foreign bank subsidiaries(26)

- Schedule 3-full service foreign banks(23)

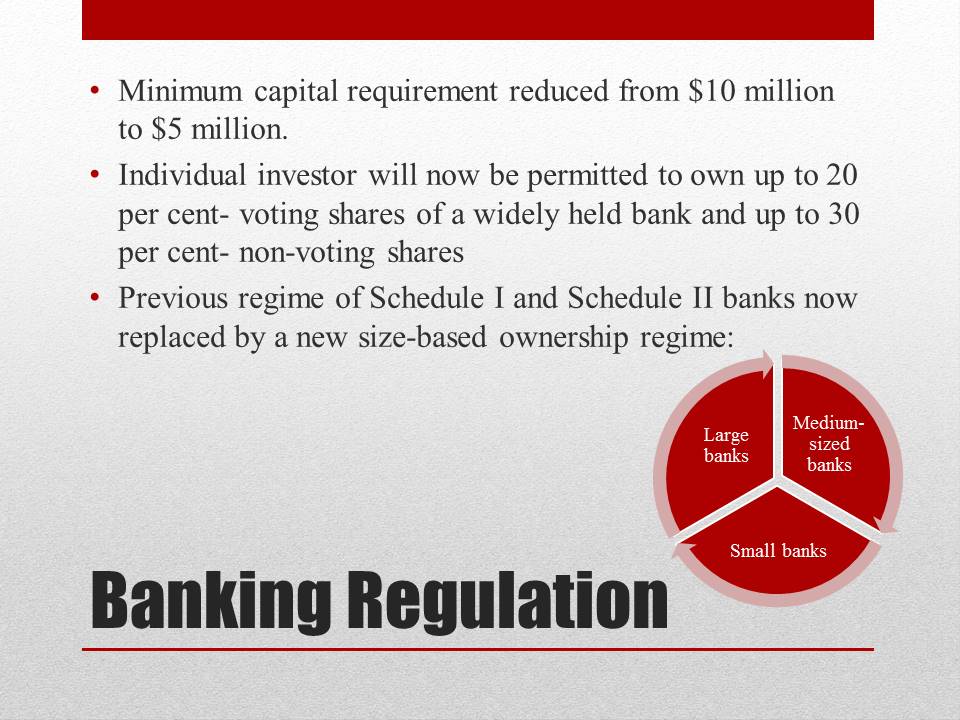

BANKING REGULATION

- Minimum capital requirement reduced from $10 million to $5 million.

- Individual investor will now be permitted to own up to 20 per cent- voting shares of a widely held bank and up to 30 per cent- nonvoting shares

- Previous regime of Schedule I and Schedule II banks now replaced by a new size-based ownership regime:

- Mediumsized banks

- Small banks

- Large banks

Slide 13- Banking System in Canada

- Additional supervisory powers given to Superintendent of Financial Institutions

- Merger review guidelines

- Bill C-8: consumer protection measures, establishment of The Financial Consumer Agency of Canada Ombudsman for Banking Services and Investments

CANADIAN DOLLAR

- 7th most traded currency in the world, accounting for 5.3% of the world’s daily share.

- Uniform Currency Act in April 1871, tying up loose ends as to the currencies of the various provinces and replacing them with a common Canadian dollar.

- The exchange rate to the US dollar was fixed at C$1.10 = US$1.00 1 Canadian dollar = 55.2332 Indian rupees

EFFECT OF SUBPRIME CRISIS

- Canadian banking system did not face a subprime mortgage crisis.

- In Canada, the Bank Act forces lenders to be more conservative than across the border.

- Canadian system is fundamentally more strong than the US banking system

- Chasing short-term returns leads to an inevitable correction in any market

CONCLUSION

- Canada’s banks are well-diversified organizations

- Canada has a strong regulatory system

- Canada’s banks are well capitalized

- Stable and prudent mortgage lending system

- Overall a strong banking system

very good

1