According to G.C. Lyrich “Capital budgeting is concerned with the allocation of firm`s financial resources among the available opportunities. The consideration of investment opportunities involves the comparison of the expected future streams of earnings from a project with the immediate and subsequent streams of earnings from a project, with the immediate and subsequent streams of expenditure.”

It is simply long term planning for making and financing proposed capital investments or projects.

Features of Capital budgeting –

- Capital Budgeting decisions involve large amount of expenditure on proposed investments.

- Capital Budgeting decisions reflect the future streams of earnings and cost of a business concern and affects their growth, thus it has a long term impact on a business.

- Capital Budgeting decisions once implemented are Irreversible

- Capital Budgeting decisions are complex as it involves forecasting of future costs and profits

Process of Capital Budgeting –

(1) Identification, Screening and Selection of investment proposals – Various projects from different departments of a firm are taken up and evaluated to conform with organization`s investment needs and projects which positively impact the future cash flows of the firm are selected.

(2) Capital Budget Proposal – After the screening and evaluation of projects, the chosen projects are subjected to capital budgeting tools to determine the future cash flows and their potential to achieve organizational objectives. Data is collected from various departments and requests of various department heads are also entertained while finalizing the projects and preparing a capital expenditure budget.

(3) Approval and Authorization of capital expenditure budget – Some additional research and analysis may be conducted before the selected projects are approved and authorized. Adequate funds are allocated to each projects and teams are appointed for implementation of the projects.

(4) Project Tracking – It involves monitoring of the work in progress and expenditure related to projects and communicating the performance to the Top Management. It aims to identify any problems associated with implementation of the project and take corrective actions to ensure smooth execution of projects.

(5) Post-Completion Audit and Performance Review – Projects may be subjected to an audit after a few years of its completion or during its implementation to assess whether it will be profitable to continue or not. All projects are not subjected to such audits but are reviewed to determine deviations in expected and actual performance.

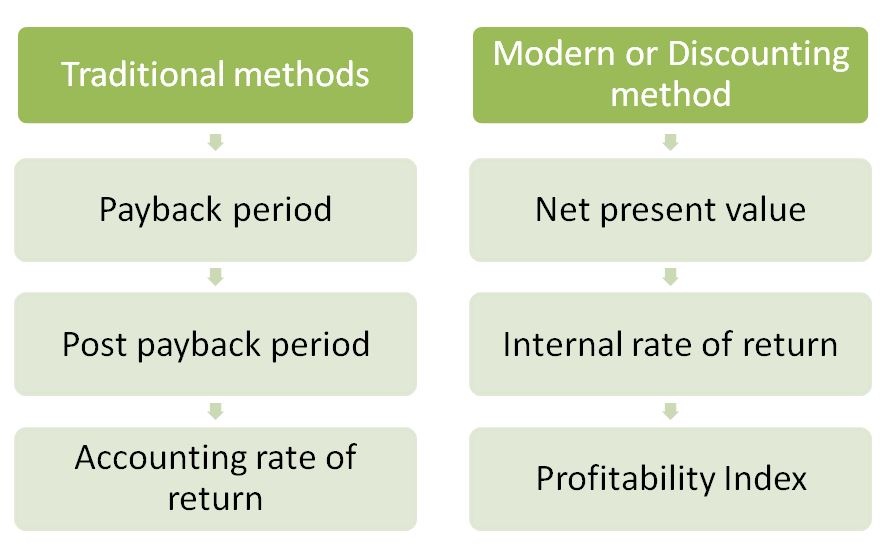

Various techniques of Capital Budgeting –

(i) Payback period – It is the time required to recover the initial investment (capital invested) in a project. It is a non-discounted cash flow method of capital budgeting.

Payback period = Initial investment ÷ Total Cash inflow

Merits –

- It is easy to calculate and simple to understand.

- It was an improvement of the Accounting rate of return method.

- It reduces the possibility of loss on account of obsolesce.

Demerits –

- It ignores time value of money.

- It ignores all cash inflows after the pay-back period.

If the actual pay-back period is less than the predetermined pay-back period, the project would be accepted.

(ii) Post Pay-back Profitability Method – This method overcomes the limitations of payback period by considering cash inflows after the payback period. It considers the returns after the payback period.

Payback period =

Initial investment ÷ Total present value of future Cash inflow

Present value of Cash inflow = Cash inflow (1 – DR%)n

Here DR%= discounting rate and n = No. of years

Post Pay back Profitability = Cash inflow (Estd. Life – Payback period)

Post Pay back Profitability index =

Post pay back profitability ÷ Initial investment

(iii) Accounting Rate of Return Method – It is a financial ratio which helps to evaluate returns and profit potential of a project. It calculates return on investment of a proposed project by taking into account the average income or profit generated by a project.

ARR or Return on Investment =

(Average profit/income ÷ Original investment) X 100

Merits –

- Based on the accounting information rather than cash inflow.

- Considers the total benefits associated with the project.

Demerits –

- It ignores time value of money.

- It ignores reinvestment potential of a project.

If the actual accounting rate of return is more than the predetermined rate of return, the project would be accepted.

(iv) Net present Value – In this method cash inflows are considered with the time value of money. It is the difference between the total present value of future cash inflows and the total present value of future cash outflows.

Net Present Value =

Total Present Value of Cash inflow – Total Present value of Cash out flow

Present value of Cash inflow = Cash inflow (1 – DR%)n

Here DR%= discounting rate and n = no. of years

Merits –

- It recognizes the time value of money.

- It considers all the benefits that are derived out of a proposed project.

- It helps to select best method for mutually exclusive projects.

Demerits –

- It is difficult to understand and calculate.

- It needs discounting factors to calculate present values.

If the present value of cash inflow is more than the present value of cash outflows, it would be accepted. Cash inflows include Net Profit after tax + depreciation.

(ii) Internal Rate of Return – It is a rate at which discount cash flows to zero i.e. Internal Rate of Return is a point where Net Present Value(NPV) is equal to Zero.

Steps to calculate IRR –

- Find out positive net present value

- Find out negative net present value

- Find out Internal Rate of Return

Internal Rate of Return =

[ Lower rate + ( Positive NPV ÷ Diff. in positive & negative NPV ) ] X DP

DP = Difference in percentage of positive & negative NPV

{Lower rate is the rate at which NPV is greater than Zero or NPV is positive}

OR

Internal Rate of Return =

[Lower + (NPV@ lower rate ÷ (NPV@lower rate — NPV@higher rate) )] X DP

Merits –

- It considers the time value of money.

- It takes into account the total cash inflow and outflow.

Demerits –

- It is difficult to compute.

- It produces multiple rates which may be confusing.

(iii) Profitability Index – It is calculated on the basis of NPV and expressed in percentage. It is the ratio of the present value of Cash inflows and present value of cash outflows.

PI = Present value of Cash Inflows ÷ Present value of cash outflows

Importance of capital budgeting →

→ It is important as it creates accountability and measurability.

→ Long term implication – Capital expenditure decision affect the company’s future cost structure over a long time span. Therefore risk should be minimized through systematic analysis of projects.

→ Irreversible decision – Capital investment decisions are not easily reversible without much financial loss to the firm.

→ Long-term commitment of funds – Long term investments lead to higher financial risk. Hence careful planning is must to reduce the financial risk.

→ Capital budgeting is also vital to a business because it creates a structured step by step process that enables a business to –

- Develop and formulate long term strategic goals

- Seek out new investment projects

- Estimate and forecast future cash flows

- Facilitate transfer of information

Its not my first time to go to see this web site, i am browsing this web page dailly and get good information from here everyday.