The Central Bank of any country plays the most important part of governance. Formulation of financial agreements in order to create financial independence.

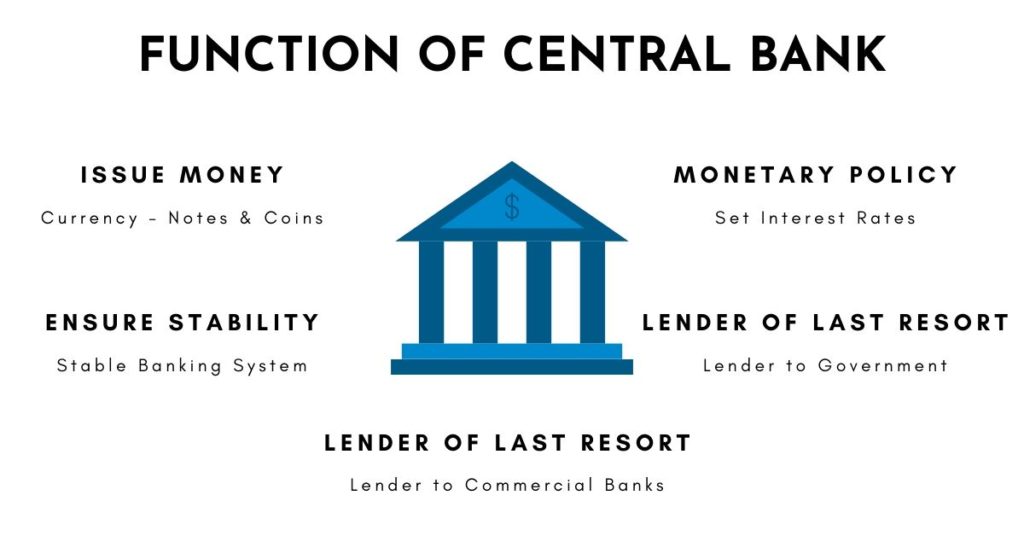

Some of the principle responsibilities that the Central Bank has to perform are:

- note issue

- banker to the government

- bankers’ bank

- lender of the last resort

- controller of credit

- maintaining a stable exchange rate

All this in conjunction with the sole focus of the economic development of the country.

Role of Central Bank in Economic Development

A developing country has a lot of challenges. Under these circumstances, it becomes imperative for the Central Bank to become the guiding light and drive economic activities and encourage inclusive economic participation from all quarters of the nation.

Some of the roles towards that goal, played by the Central bank are:

- promotion and maintenance of a rising level of production

- employment

- real income in the country

Role of the Central bank towards financial diversification:

The Central Bank is created with the sole purpose of developing an effective financial environment that will drive the economic growth of the country. For developing and underdeveloped nations this role becomes even more prominent. The Central Bank will then not only have to attend to institution-building but also improve the currency and credit system.

A mixed spread of bank and credit facilities have to be maintained to cater to a large number of individuals and businesses. The Central bank becomes the sole authority to create regulations for the functioning of these institutions. Roles and responsibilities have to be decided and anointed to the respective entities. The Central Bank will also be responsible for the formulation of Due diligence procedures, in order to provide adequate safeguards to the financial institutions.

Central Bank and Social Financial Responsibility

In developing countries as well as the underdeveloped ones, the spread of banks and financial institutions is highly skewed. They are mostly situated in big cities, thereby depriving a vast majority, who usually reside in the rural areas, of financial facilities and overall economic freedom. These individuals or communities fall prey to the village moneylender, who fleece them with exorbitantly high rates.

The Central Bank, therefore, has to remedy this situation and create more outlets that will help these communities sustain business and add to the overall economic development of the country. The other shortcoming faced by the rural community is the paucity of sustainable loans. Commercial banks in underdeveloped and developing economies stress more on short term loans thereby denting long term efforts for setting up successful ventures.

The ideal circumstance is to have provisions for long term loans that can benefit the business. In this regard, a network of cooperative credit societies linked to apex banks at the helm and financed by the central bank can be a game-changer. These credit societies should be able to disburse short term, middle term, and long term loans.

The Central Bank at most times will have a vast resource at its disposal. With this corpus, it can directly lead banks to create more opportunities that will be beneficial for the rural community both in setting up new ventures as well as increase the farm output.

Balance of demand and supply of money by Central bank

The correct balance of demand and supply of money is an extremely important function that has to be overseen by the Central bank. An imbalance on any scale will lead to a financial crisis. A shortage of money will often lead to stunted growth and the full potential of the country will not be exploited. An excess of money will lead to inflation.

With the increase in the size of the economy, the demand for money will exponentially grow. This is because more and more sectors will go through the process of monetization. Industries will grow and so will the agricultural output.

However, with the rise of additional sectors, demand for money for transactions and speculative purposes will also grow. So the increase in the money supply has to be proportionately more to the demand for money. This needs to be done to avoid inflation. Increased supply of to be used for speculative purposes can lead to inhibition of growth and inflation.

The Central Bank, therefore, has to control the supply of money and credit by introducing a suitable monetary policy. For underdeveloped as well as developing countries, The Central Bank has to, therefore, control the supply of money in a way that there is bare minimum fluctuation in prices as well as creating and actively promoting a conducive environment for increased investment and national output.

Central Bank and Interest Rate Policy

The Interest Rate of the banks in a country is mandated by the Central Bank through a suitable Interest Rate policy. However, the rates should be such that it can be effective as a driver for development and not become a financial burden. In underdeveloped and developing countries to an extent, there is a great disparity between interest rates. Also, standard rates happen to be extremely high. There are huge disparities between long term and short term rates as well rates issued to different industries and sectors. High-interest rates are a bane towards development and discourage both public and private investments.

Hence, it is always advisable to have a low-interest rate so as to encourage greater investments. Industries and agriculture are magnets of huge investments and constant cash flow has to be maintained to keep them moving. If the cost of borrowing money increases, an additional financial burden is placed on the borrower. It is hence, essential for the Central Bank to monitor and mandate financial institutions to charge appropriate interest rates on loans, keeping in mind the interest of both the rising economy as well as the expenses incurred while servicing the loan.

The Central Bank also follows a policy of discriminatory interest rates. That would mean it charges higher interest rates for non-essential loans and lowers for essential and productive loans.

Monetary Policy and Central Bank

It is imperative to know that savings, in a developing and an underdeveloped economy, are not elastic with respect to the interest rate. The Central Bank, through a judicious monetary policy, has to balance between a stable price level, savings, and interest rates. High-interest rates will be detrimental to savings. A growing economy will also be directly proportional to an increase in price levels. If there is a decline in the value of money, then the urge to save money further decreases. Under such conditions the monetary controls are tightened which has an impact on the interest rates. This increases inflation. To counter this, if the Central Bank pushes the rate of interest further, it will have a disastrous effect on the economy. Hence, the role of the Central Bank would be to check price levels, keep inflation within manageable proportions, and promote greater savings. If all of this maintained, it can be said that the monetary policy has been truly successful.

Debt Management and Central Bank

One of the most important functions of a Central Bank is to maintain an effective Debt Management policy. It has kept in mind quite a few things while doing so.

- The timing of issuance Government bonds

- Stabilizing prices of the government bonds

- And keeping down the cost of servicing public debt to manageable limits

The Central Bank is in absolute authority to sell and buy government bonds. They would also have to make timely structural changes in the composition of public debt.

However, just issuing Government bonds will not suffice. A market has to be created in order to sell them. In order to do so, the Central Bank follows the policy of lowering interest rates. This increases the prices of Government bonds and thereby making it attractive. This, in turn, provides an impetus to the public borrowing programs scheduled by the government. Private firms can then start funding the debts, expecting sizeable returns.

However, for debt management to happen successfully, there needs to be in existence well-established money and capital markets. These markets should be having securities of a wide range on offer. The Central Bank has the responsibility of developing these markets.

Credit Control and Central Bank

Controlling the credit is also one of the responsibilities of the Central Bank. This goes a long way in influencing the pattern of investment and output of the country. During the process of development, there are inflationary pressures on the economy.

The Central bank has to, therefore, use both quantitative and qualitative measures to control inflation.

Open markets can only function successfully if the bill market is large and developed. For underdeveloped and developing nations, these are small. Commercial banks prefer to keep an elastic cash deposit ratio because the Central Bank does not have complete control over them. These banks are also reluctant investors when it comes to government bonds because of the low-interest rates.

The commercial banks also prefer to keep their reserves liquid. That is most of their reserves are in gold, foreign exchange, and cash. Also, these banks do not follow rediscounting or borrowing from the central bank. The Central Bank, therefore, has to create enough mechanisms where the bill market expands, Government bonds become an attractive option to sell.

Some of the reasons why bank rate policies are ineffective in controlling the LDC’s:

- Lack of bills of discounts

- The narrow size of the bill market

- A large non-monetized sector where barter transactions take place;

- The existence of a large unorganized money market;

- The existence of indigenous banks which do not discount bills with the central banks

- The habit of commercial banks to keep large cash reserves.

The use of a variable reserve ratio as a method of credit control is more effective than open market operations and bank rate policy in LDCs. Since the market for securities is very small, open market operations are not successful. But a rise or fall in the reserve ratio by the central bank reduces or increases the cash available with the commercial banks without affecting adversely the prices of securities.

The central bank’s role, as suggested earlier is divided into two parts: Qualitative and Quantitative control of the allocation of credit. In developing economies, there is a strong propensity to invest in gold, real estate, inventories, et al, instead of industries, mining, and agriculture.

The credit controls hence have to be selectively focussing more on controlling and limiting credit facilities for such unproductive purposes. They have been found to be beneficial in controlling speculative activities. Sectional inflations can be controlled through selective credit control mechanisms.

One of the other areas of influence through Credit Control is the regulation of imports. Through credit control, imports can be curtailed by the imposition of an obligatory financial barrier which has to be equal to the import amount. Through selective credit control measures may also lead to the changing of margin requirements against selected collaterals, regulating consumer credit and rationing of credit.

Balancing the Balance of Payment Challenge

Developing nations do face the challenge of balancing the balance of payments issue. There is a wide rift between import and export and this gap continues to increase as the rate of development accelerates. If not checked, this could lead to serious economic hardship and the objective to fulfill developmental plans may get scuttled.

The role of the Central bank in this regard assumes greater significance. They control the foreign exchange of the country and also act as the technical advisor to the government. The Central Bank has to control the fluctuations in the foreign exchange rates and maintain stability. This is primarily done through exchange controls and variations in the bank rate. One prime example being the freefall of the national currency. In such times, the Central bank raises the bank rate and encourages the inflow of foreign exchange.

Conclusion:

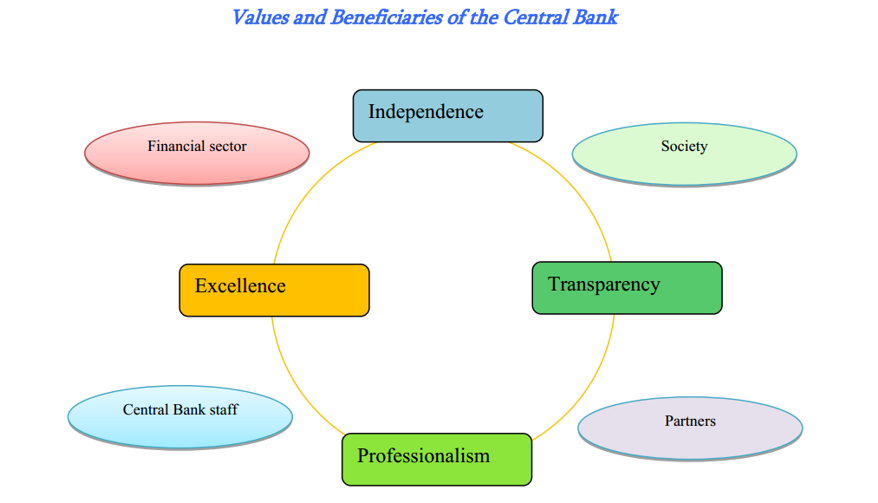

The Central Bank of every country is at the helm of the financial and monetary policy. It is the driver of economic development and supplements the effort of the other ministries in promoting development and encouraging sound fiscal practices.

Наш ресурс публикует важные новостные материалы разных сфер.

Здесь представлены новости о политике, культуре и разнообразных темах.

Новостная лента обновляется почти без перерывов, что позволяет следить за происходящим.

Минималистичный дизайн помогает быстро ориентироваться.

https://luxe-moda.ru

Каждая статья оформлены качественно.

Целью сайта является объективности.

Присоединяйтесь к читателям, чтобы быть всегда информированными.