Project/Slides/Presentation Transcript

Topic – Calculation of Net taxable Income of Cricketers in India

Slide 1 – Net Taxable Income of cricketers in India

Slide 2 – About Virender Sehwag

Virender Sehwag is one of the leading batsmen in the Indian cricket team. Sehwag is right-handed opening batsman and a part-time right-arm off-spin bowler. He played his first One Day International in 1999 and joined the Indian Test cricket team in 2001.

In April 2009, Sehwag became the only Indian to be honoured as the Wisden Leading Cricketer in the World for his performance in 2008, subsequently becoming the first player of any nationality to retain the award for 2009.

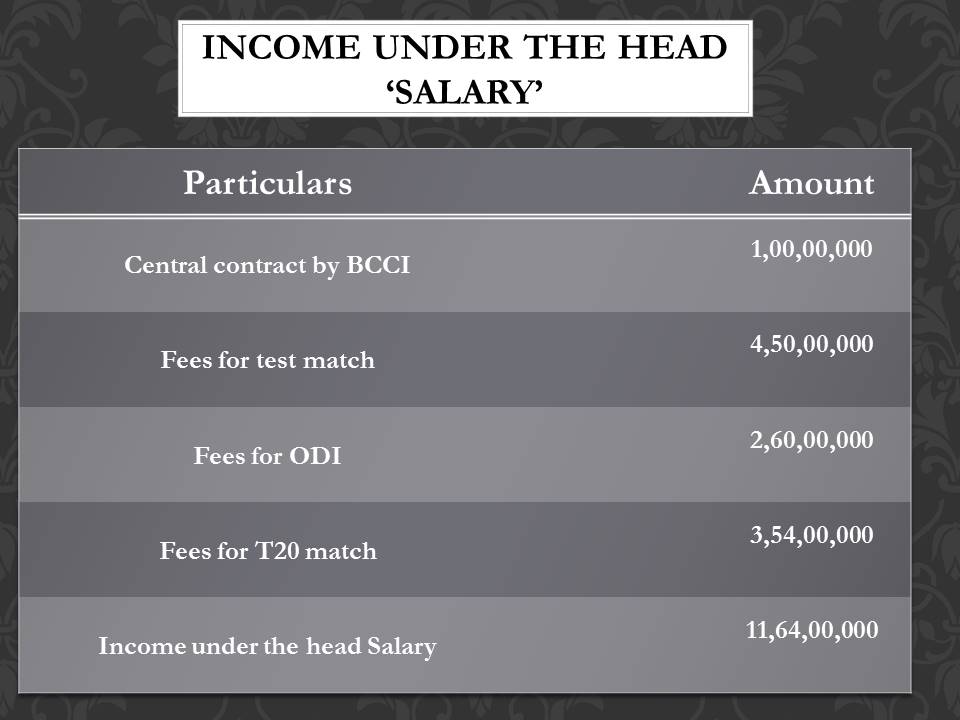

Slide 3 – Income under the head salary

| Particulars | Amount |

| Central contract by BCCI | 1,00,00,000 |

| Fees for test match | 4,50,00,000 |

| Fees for ODI | 2,60,00,000 |

| Fees for T20 match | 3,54,00,000 |

| Income under the head Salary | 11,64,00,000 |

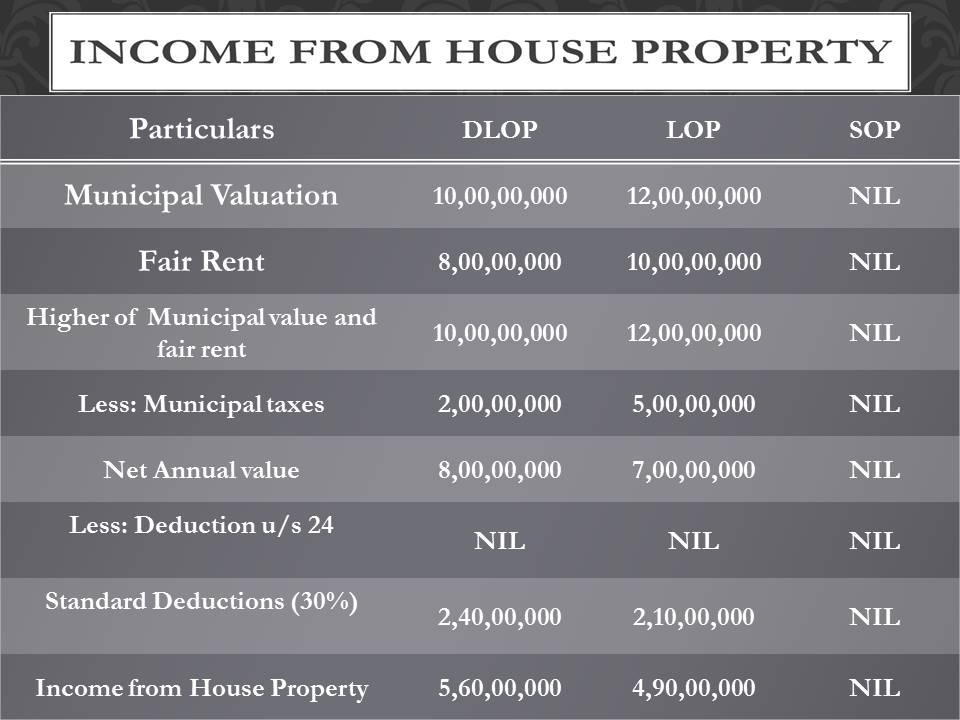

Slide 4 – Income from house property

| Particulars | DLOP | LOP | SOP |

| Municipal Valuation | 10,00,00,000 | 12,00,00,000 | NIL |

| Fair Rent | 8,00,00,000 | 10,00,00,000 | NIL |

| Higher of Municipal value and fair rent | 10,00,00,000 | 12,00,00,000 | NIL |

| Less: Municipal taxes | 2,00,00,000 | 5,00,00,000 | NIL |

| Net Annual value | 8,00,00,000 | 7,00,00,000 | NIL |

| Less: Deduction u/s 24 | NIL | NIL | NIL |

| Standard Deductions (30%) | 2,40,00,000 | 2,10,00,000 | NIL |

| Income from House Property | 5,60,00,000 | 4,90,00,000 | NIL |

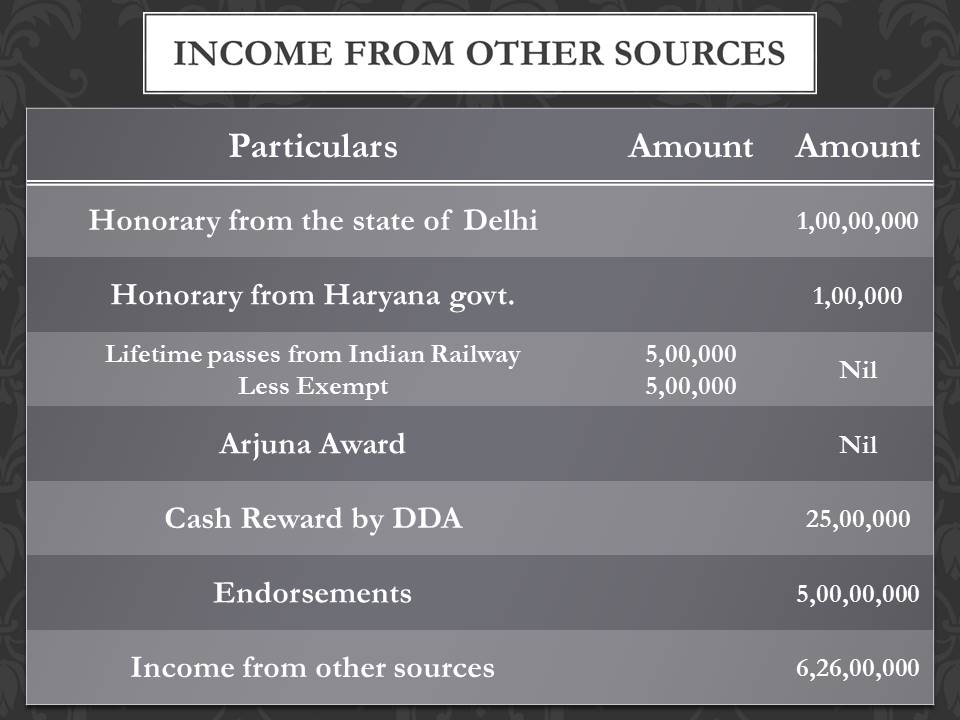

Slide 5 – Income from other sources

| Particulars | Amount | Amount |

| Honorary from the state of Delhi | 1,00,00,000 | |

| Honorary from Haryana govt. | 1,00,000 | |

| Lifetime passes from Indian Railway

Less Exempt |

5,00,000

5,00,000 |

Nil |

| Arjuna Award | Nil | |

| Cash Reward by DDA | 25,00,000 | |

| Endorsements | 5,00,00,000 | |

| Income from other sources | 6,26,00,000 |

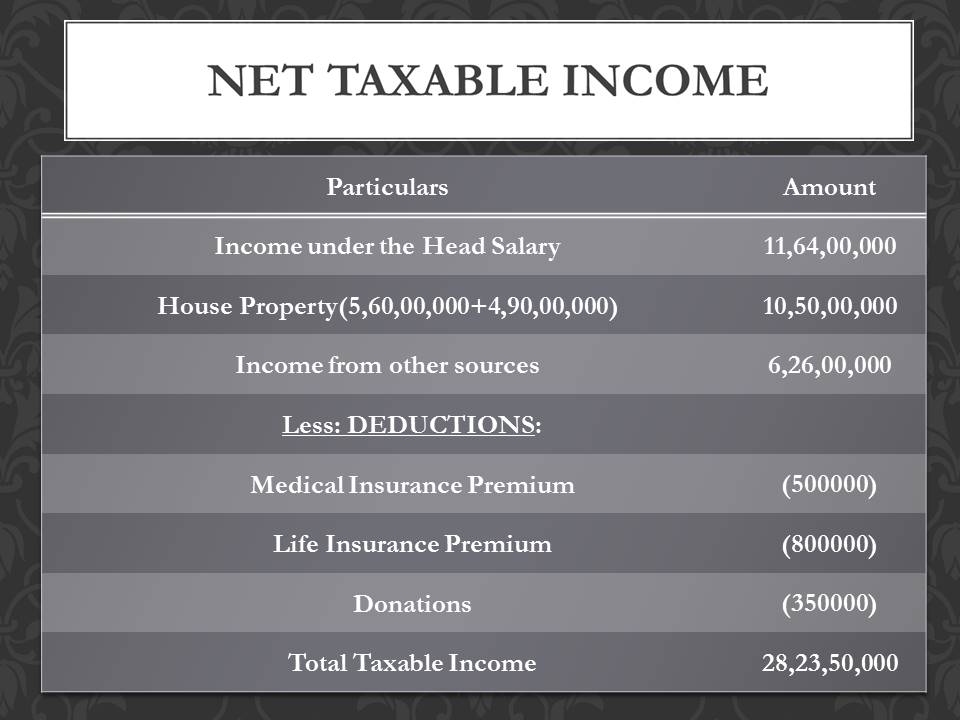

Slide 6 – Net Taxable Income

| Particulars | Amount |

| Income under the Head Salary | 11,64,00,000 |

| House Property(5,60,00,000+4,90,00,000) | 10,50,00,000 |

| Income from other sources | 6,26,00,000 |

| Less: DEDUCTIONS: | |

| Medical Insurance Premium | (500000) |

| Life Insurance Premium | (800000) |

| Donations | (350000) |

| Total Taxable Income | 28,23,50,000 |

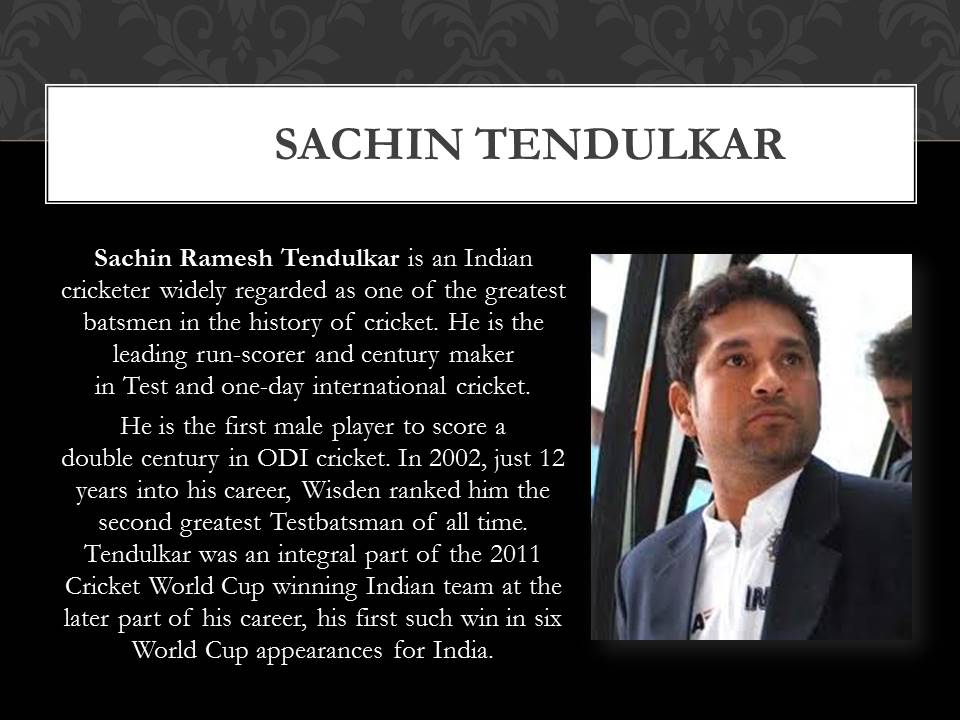

Slide 7 – About Sachin Tendulkar

Sachin Ramesh Tendulkar is an Indian cricketer widely regarded as one of the greatest batsmen in the history of cricket. He is the leading run-scorer and century maker in Test and one-day international cricket.

He is the first male player to score a double century in ODI cricket. In 2002, just 12 years into his career, Wisden ranked him the second greatest Testbatsman of all time. Tendulkar was an integral part of the 2011 Cricket World Cup winning Indian team at the later part of his career, his first such win in six World Cup appearances for India.

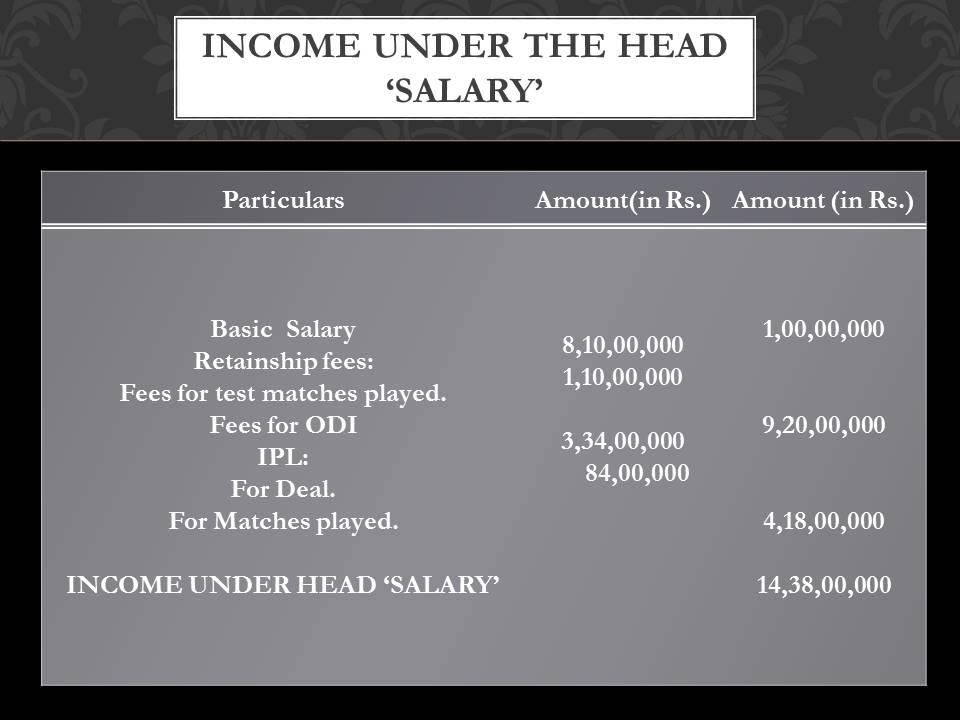

Slide 8 – Income under the head salary

| Particulars | Amount(in Rs.) | Amount (in Rs.) |

| Basic Salary

Retainship fees: Fees for test matches played. Fees for ODI IPL: For Deal. For Matches played. INCOME UNDER HEAD ‘SALARY’ |

8,10,00,000

1,10,00,000 3,34,00,000 84,00,000 |

1,00,00,000

9,20,00,000 4,18,00,000 14,38,00,000 |

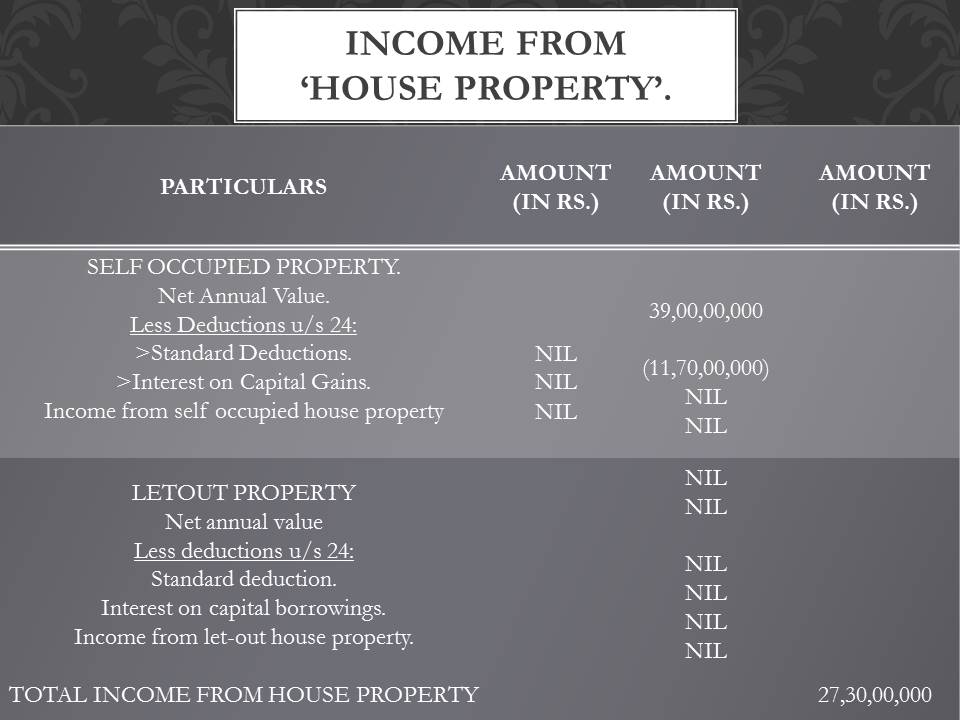

Slide 9 – Income from house property

| PARTICULARS | AMOUNT (IN RS.) | AMOUNT

(IN RS.) |

AMOUNT

(IN RS.) |

| SELF OCCUPIED PROPERTY.

Net Annual Value. Less Deductions u/s 24: >Standard Deductions. >Interest on Capital Gains. Income from self occupied house property |

NIL

NIL NIL |

39,00,00,000 (11,70,00,000) NIL NIL |

|

| LETOUT PROPERTY

Net annual value Less deductions u/s 24: Standard deduction. Interest on capital borrowings. Income from let-out house property. TOTAL INCOME FROM HOUSE PROPERTY |

NIL

NIL NIL NIL NIL NIL |

27,30,00,000 |

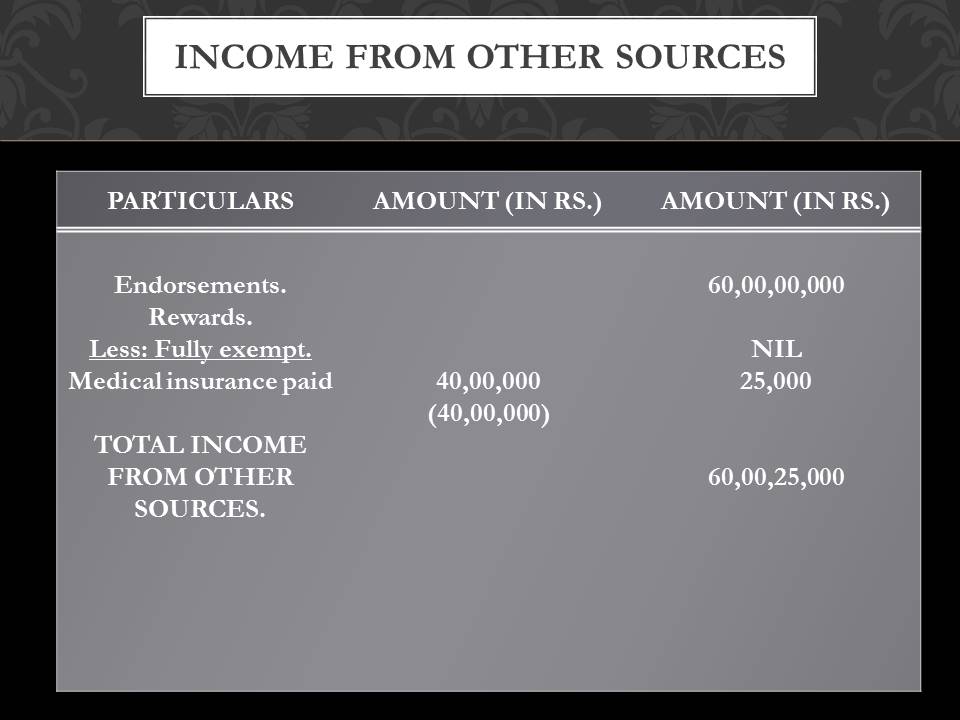

Slide 10 – Income from other sources

| PARTICULARS | AMOUNT (IN RS.) | AMOUNT (IN RS.) |

| Endorsements.

Rewards. Less: Fully exempt. Medical insurance paid TOTAL INCOME FROM OTHER SOURCES. |

40,00,000

(40,00,000) |

60,00,00,000

NIL 25,000

60,00,25,000 |

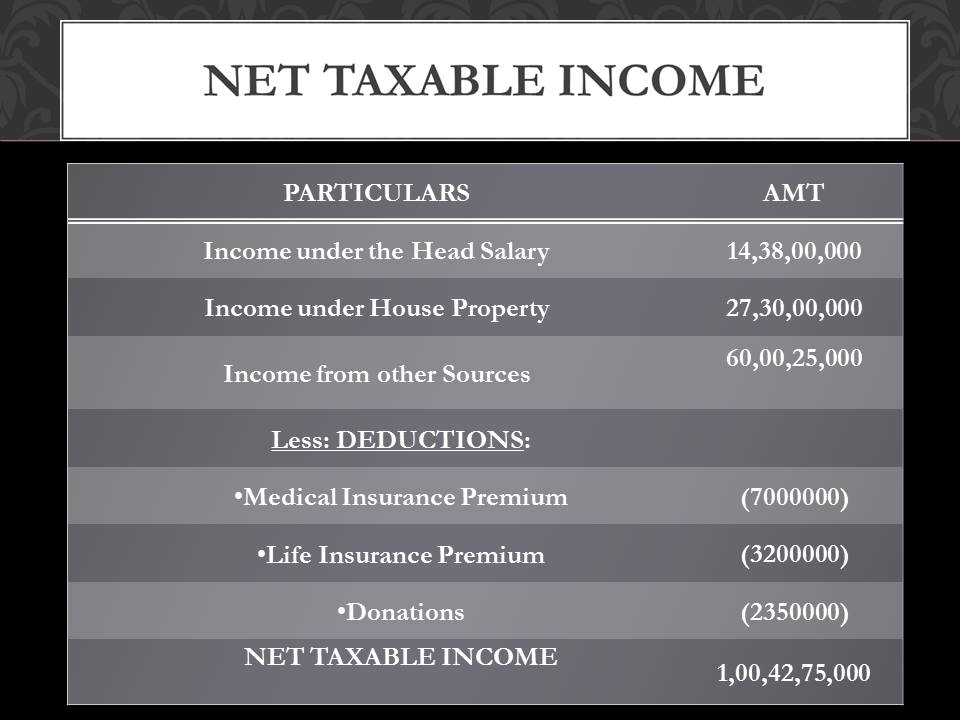

Slide 11 – Net Taxable Income

| PARTICULARS | AMT |

| Income under the Head Salary | 14,38,00,000 |

| Income under House Property | 27,30,00,000 |

| Income from other Sources | 60,00,25,000 |

| Less: DEDUCTIONS: | |

| •Medical Insurance Premium | (7000000) |

| •Life Insurance Premium | (3200000) |

| •Donations | (2350000) |

| NET TAXABLE INCOME | 1,00,42,75,000 |

Slide 12 – About Gautam Gambhir

Gautam Gambhir (born on 14 October 1981, in Delhi) is an Indian cricketer, a batsman. He has been a member of the Indian national cricket team since 2003 (ODIs) and 2004 (Tests). Gambhir had been a prolific run-scorer in domestic cricket with an average of over 50.

Gambhir became only the fourth Indian batsman to score a double century in a tour game at home; the previous three being Sunil Gavaskar, Dilip Vengsarkar and Sachin Tendulkar.

On July 2009, for a period of ten days he was the number one ranked batsman in ICC Test rankings.

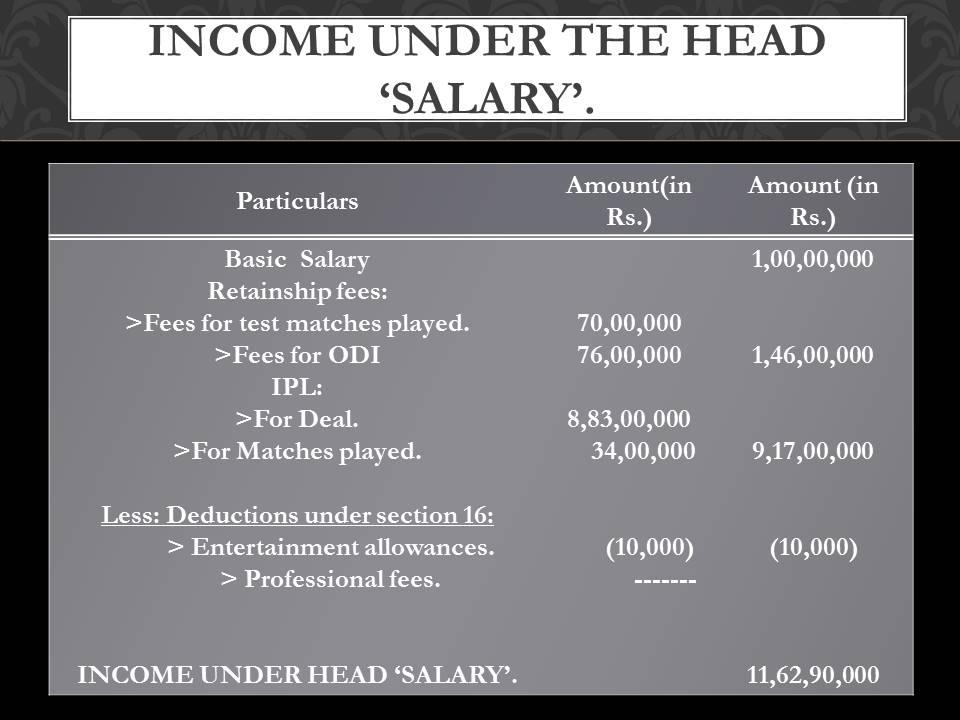

Slide 13 – Income under the head salary

| Particulars | Amount(in Rs.) | Amount (in Rs.) |

| Basic Salary

Retainship fees: >Fees for test matches played. >Fees for ODI IPL: >For Deal. >For Matches played. Less: Deductions under section 16: > Entertainment allowances. > Professional fees. INCOME UNDER HEAD ‘SALARY’. |

70,00,000

76,00,000 8,83,00,000 34,00,000

(10,000) ——- |

1,00,00,000

1,46,00,000 9,17,00,000 (10,000) 11,62,90,000 |

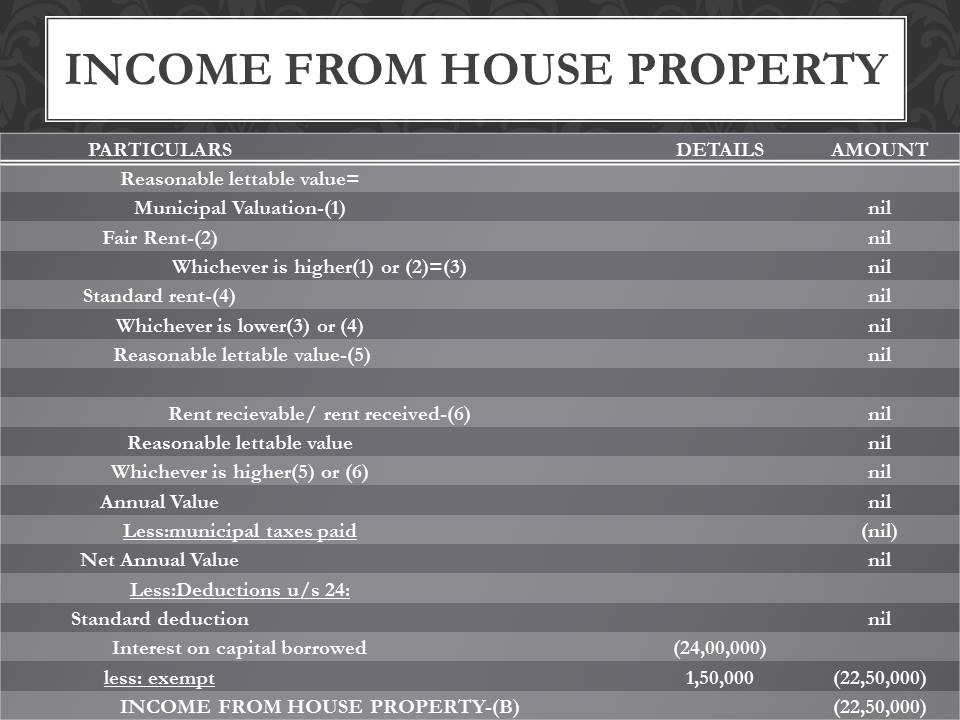

Slide 14 – Income from house property

| PARTICULARS | DETAILS | AMOUNT | |||

| Reasonable lettable value= | |||||

| Municipal Valuation-(1) | nil | ||||

| Fair Rent-(2) | nil | ||||

| Whichever is higher(1) or (2)=(3) | nil | ||||

| Standard rent-(4) | nil | ||||

| Whichever is lower(3) or (4) | nil | ||||

| Reasonable lettable value-(5) | nil | ||||

| Rent recievable/ rent received-(6) | nil | ||||

| Reasonable lettable value | nil | ||||

| Whichever is higher(5) or (6) | nil | ||||

| Annual Value | nil | ||||

| Less:municipal taxes paid | (nil) | ||||

| Net Annual Value | nil | ||||

| Less:Deductions u/s 24: | |||||

| Standard deduction | nil | ||||

| Interest on capital borrowed | (24,00,000) | ||||

| less: exempt | 1,50,000 | (22,50,000) | |||

| INCOME FROM HOUSE PROPERTY-(B) | (22,50,000) | ||||

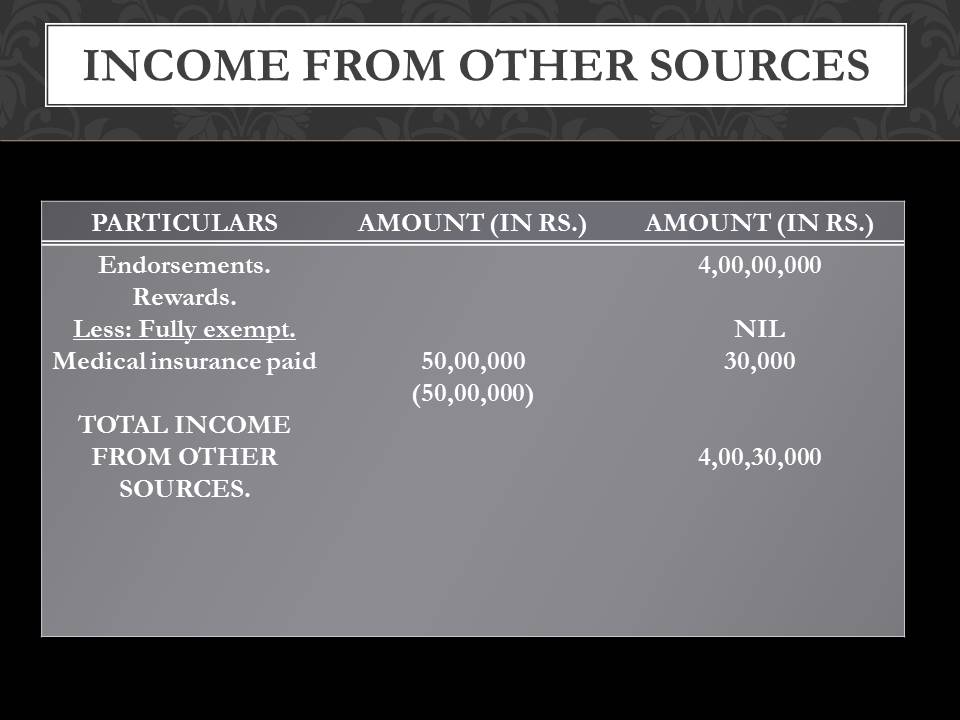

Slide 15 – Income from other sources

| PARTICULARS | AMOUNT (IN RS.) | AMOUNT (IN RS.) |

| Endorsements.

Rewards. Less: Fully exempt. Medical insurance paid TOTAL INCOME FROM OTHER SOURCES. |

50,00,000

(50,00,000) |

4,00,00,000

NIL 30,000

4,00,30,000 |

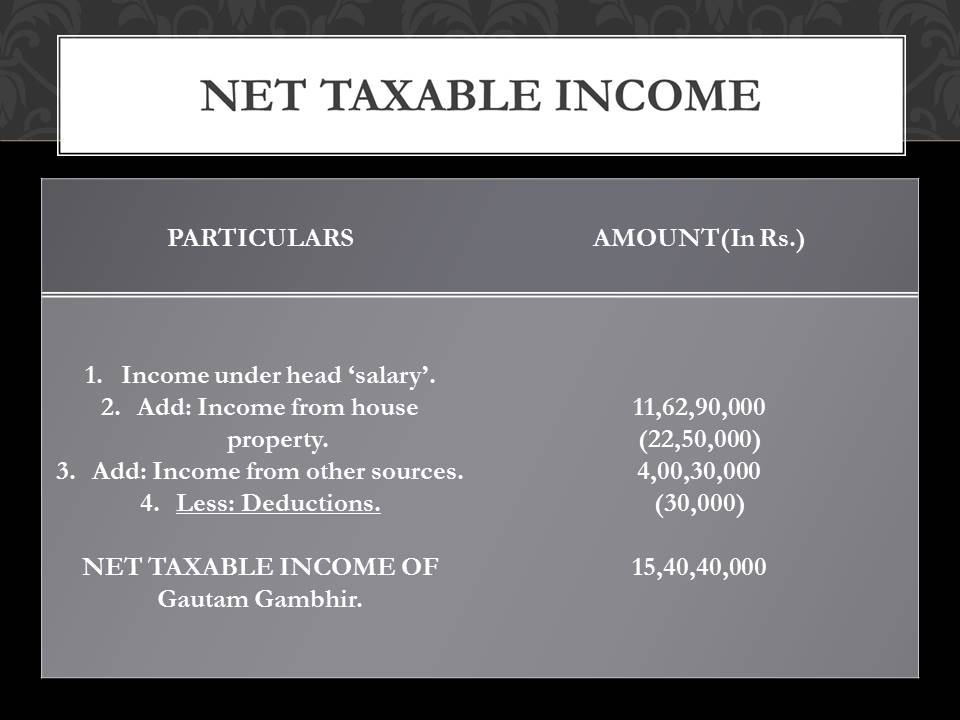

Slide 16 – Net Taxable Income

| PARTICULARS | AMOUNT(In Rs.) |

| 1.Income under head ‘salary’.

2.Add: Income from house property. 3.Add: Income from other sources. 4.Less: Deductions. ● NET TAXABLE INCOME OF Gautam Gambhir. |

11,62,90,000

(22,50,000) 4,00,30,000 (30,000) 15,40,40,000 |

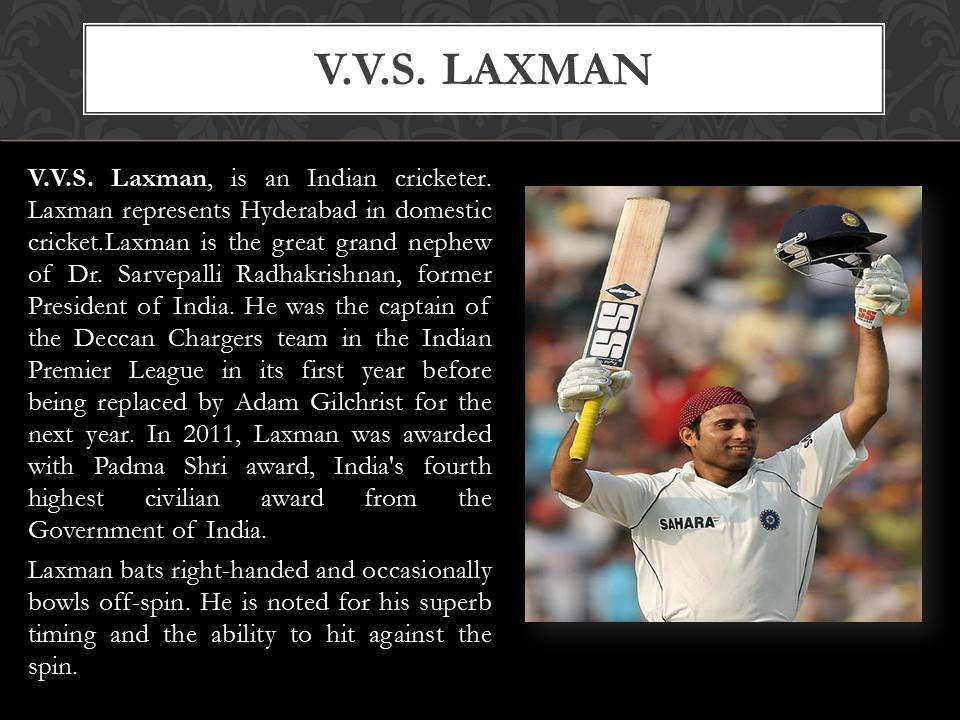

Slide 17 – About VVS Laxman

V.V.S. Laxman, is an Indian cricketer. Laxman represents Hyderabad in domestic cricket.Laxman is the great grand nephew of Dr. Sarvepalli Radhakrishnan, former President of India. He was the captain of the Deccan Chargers team in the Indian Premier League in its first year before being replaced by Adam Gilchrist for the next year. In 2011, Laxman was awarded with Padma Shri award, India’s fourth highest civilian award from the Government of India.

Laxman bats right-handed and occasionally bowls off-spin. He is noted for his superb timing and the ability to hit against the spin.

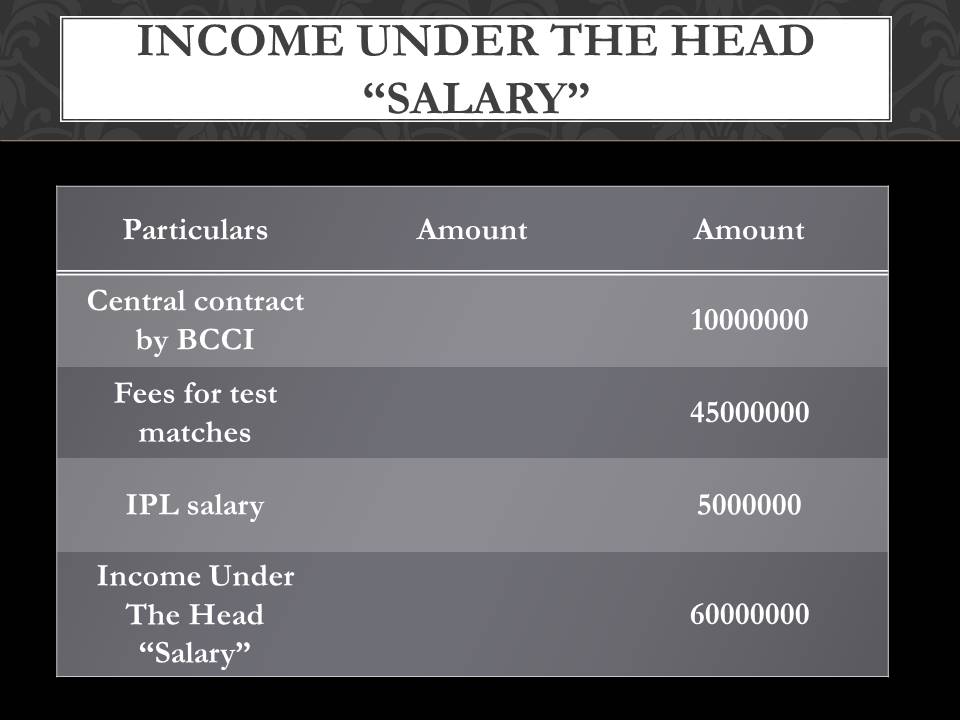

Slide 18 – Income under the head salary

| Particulars | Amount |

| Central contract by BCCI | 10000000 |

| Fees for test matches | 45000000 |

| IPL salary | 5000000 |

| Income Under The Head “Salary” | 60000000 |

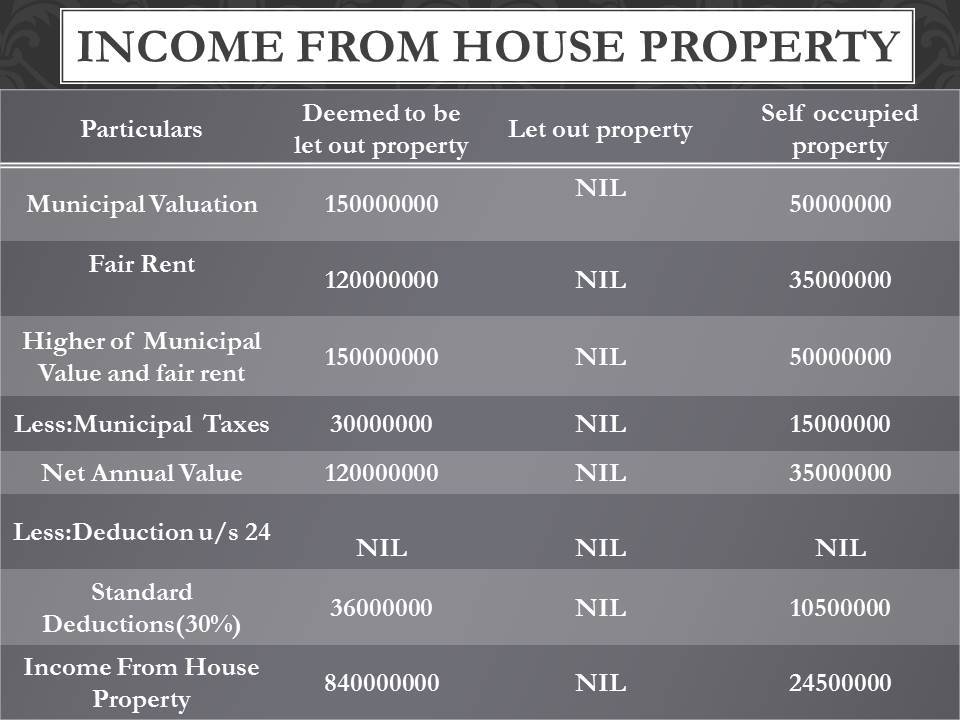

Slide 19 – Income from house property

| Particulars | Deemed to be let out property | Let out property | Self occupied property |

| Municipal Valuation | 150000000 | NIL | 50000000 |

| Fair Rent | 120000000 | NIL | 35000000 |

| Higher of Municipal Value and fair rent | 150000000 | NIL | 50000000 |

| Less:Municipal Taxes | 30000000 | NIL | 15000000 |

| Net Annual Value | 120000000 | NIL | 35000000 |

| Less:Deduction u/s 24 | NIL | NIL | NIL |

| Standard Deductions(30%) | 36000000 | NIL | 10500000 |

| Income From House Property | 840000000 | NIL | 24500000 |

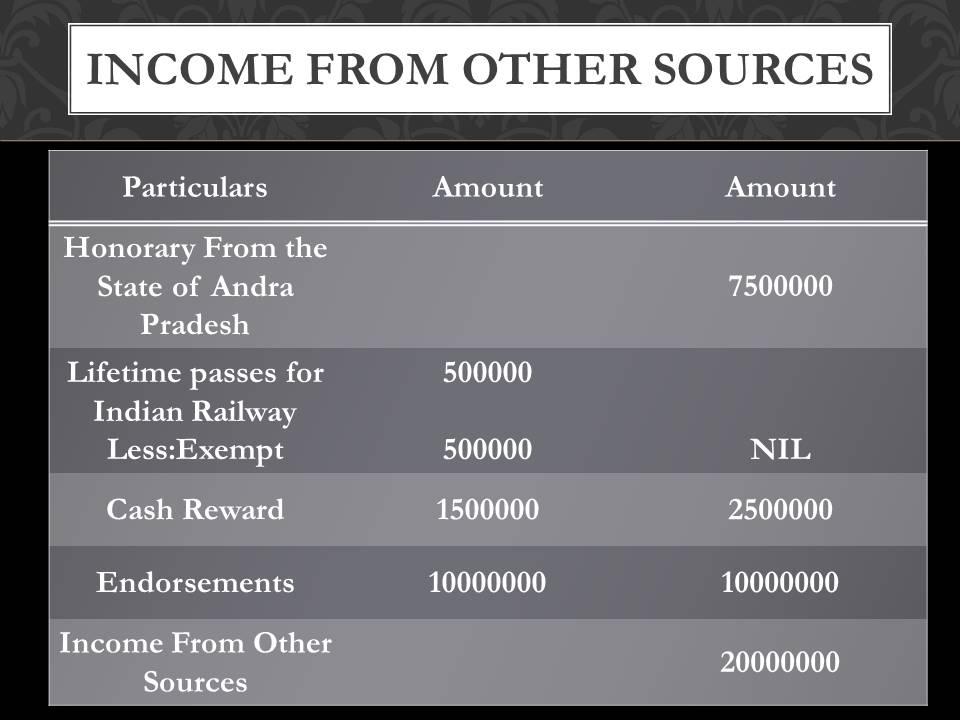

Slide 20 – Income from other sources

| Particulars | Amount | Amount |

| Honorary From the State of Andra Pradesh | 7500000 | |

| Lifetime passes for Indian Railway

Less:Exempt |

500000

500000 |

NIL |

| Cash Reward | 1500000 | 2500000 |

| Endorsements | 10000000 | 10000000 |

| Income From Other Sources | 20000000 |

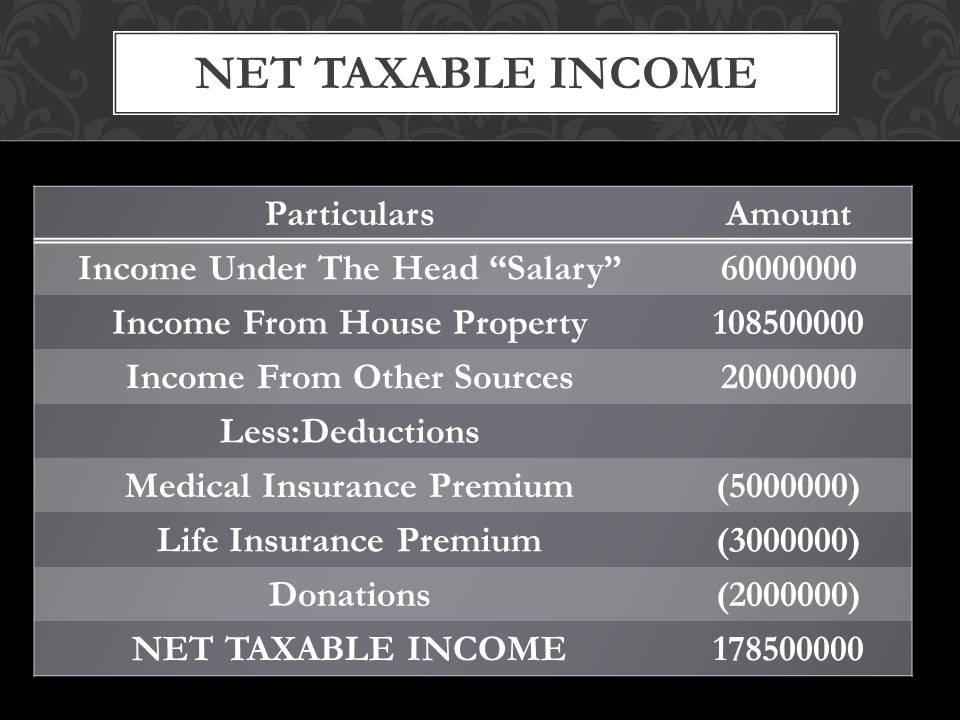

Slide 21 – Net Taxable Income

| Particulars | Amount |

| Income Under The Head “Salary” | 60000000 |

| Income From House Property | 108500000 |

| Income From Other Sources | 20000000 |

| Less:Deductions | |

| Medical Insurance Premium | (5000000) |

| Life Insurance Premium | (3000000) |

| Donations | (2000000) |

| NET TAXABLE INCOME | 178500000 |

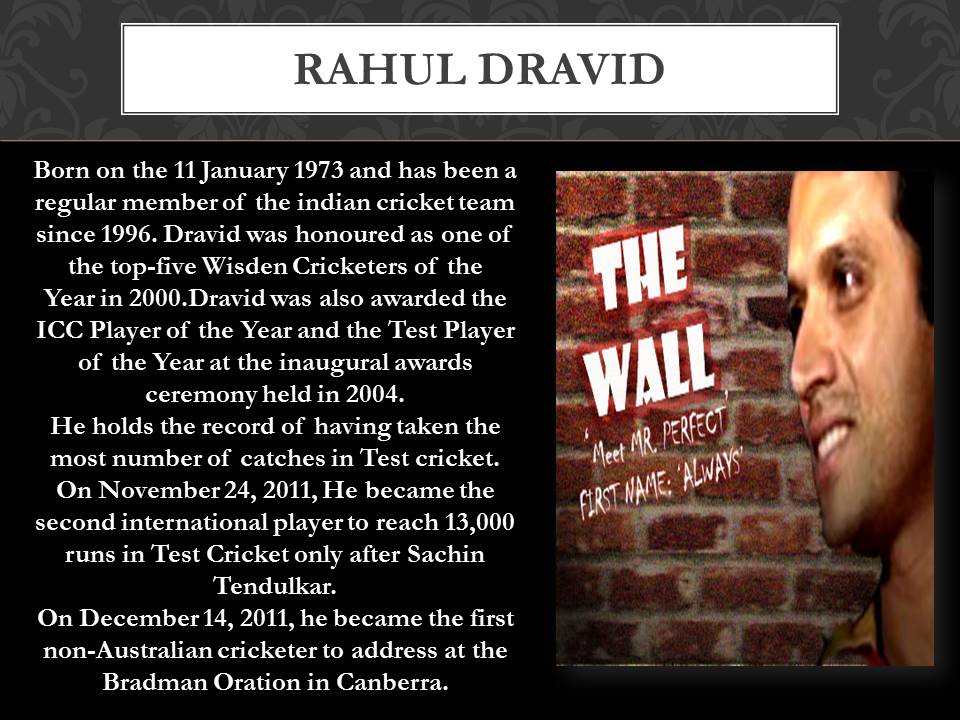

Slide 22 – About Rahul Dravid

Born on the 11 January 1973 and has been a regular member of the indian cricket team since 1996. Dravid was honoured as one of the top-five Wisden Cricketers of the Year in 2000.Dravid was also awarded the ICC Player of the Year and the Test Player of the Year at the inaugural awards ceremony held in 2004.

He holds the record of having taken the most number of catches in Test cricket.

On November 24, 2011, He became the second international player to reach 13,000 runs in Test Cricket only after Sachin Tendulkar.

On December 14, 2011, he became the first non-Australian cricketer to address at the Bradman Oration in Canberra.

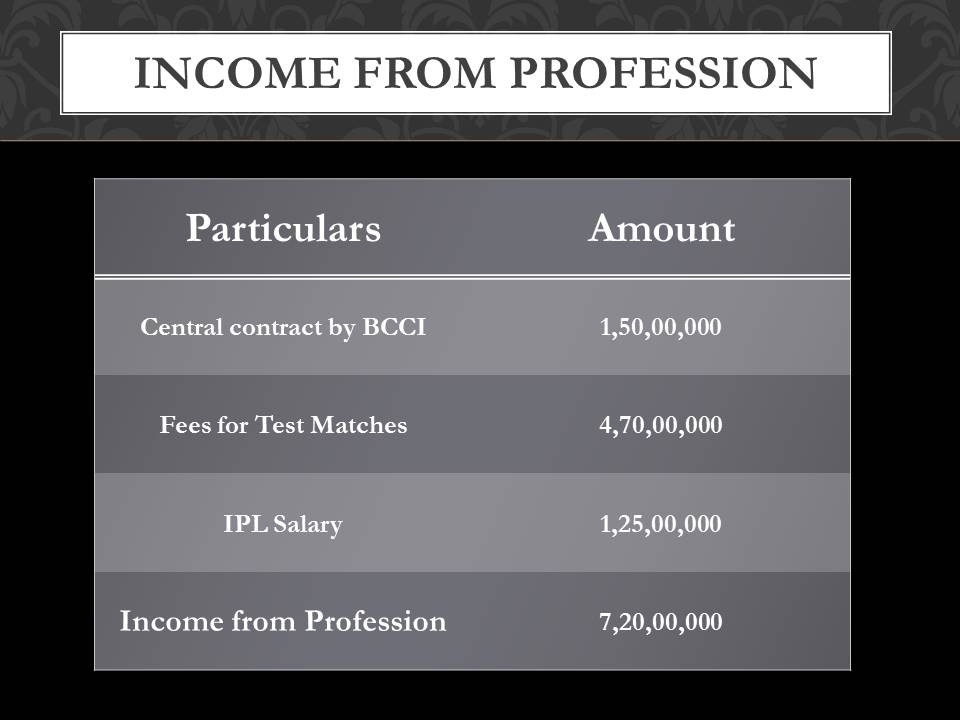

Slide 23 – Income from profession

| Particulars | Amount |

| Central contract by BCCI | 1,50,00,000 |

| Fees for Test Matches | 4,70,00,000 |

| IPL Salary | 1,25,00,000 |

| Income from Profession | 7,20,00,000 |

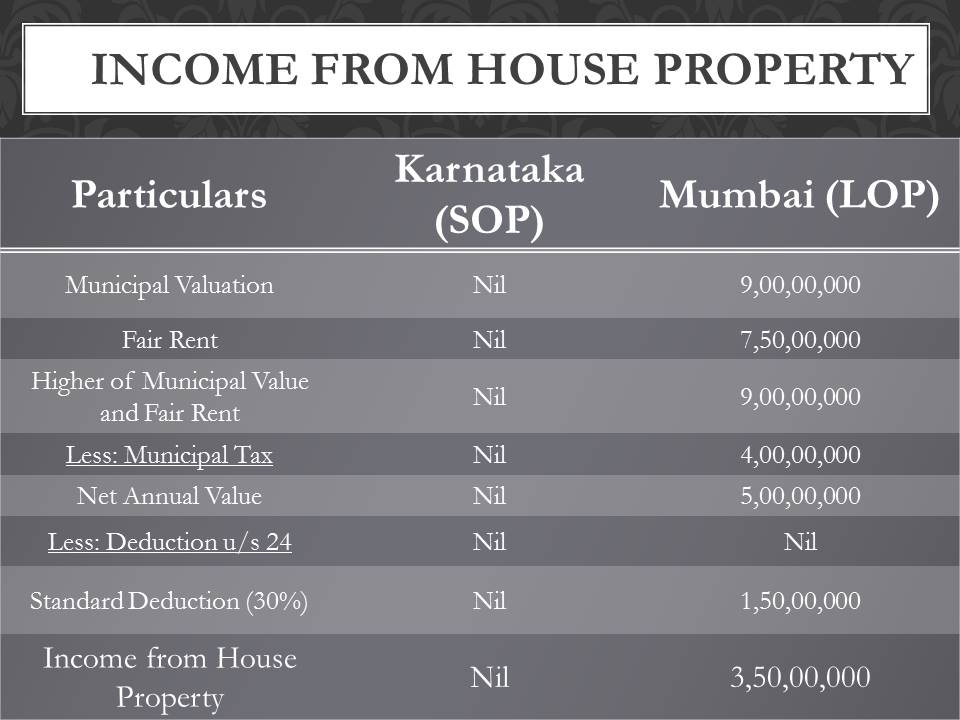

Slide 24 – Income from house property

| Particulars | Karnataka (SOP) | Mumbai (LOP) |

| Municipal Valuation | Nil | 9,00,00,000 |

| Fair Rent | Nil | 7,50,00,000 |

| Higher of Municipal Value and Fair Rent | Nil | 9,00,00,000 |

| Less: Municipal Tax | Nil | 4,00,00,000 |

| Net Annual Value | Nil | 5,00,00,000 |

| Less: Deduction u/s 24 | Nil | Nil |

| Standard Deduction (30%) | Nil | 1,50,00,000 |

| Income from House Property | Nil | 3,50,00,000 |

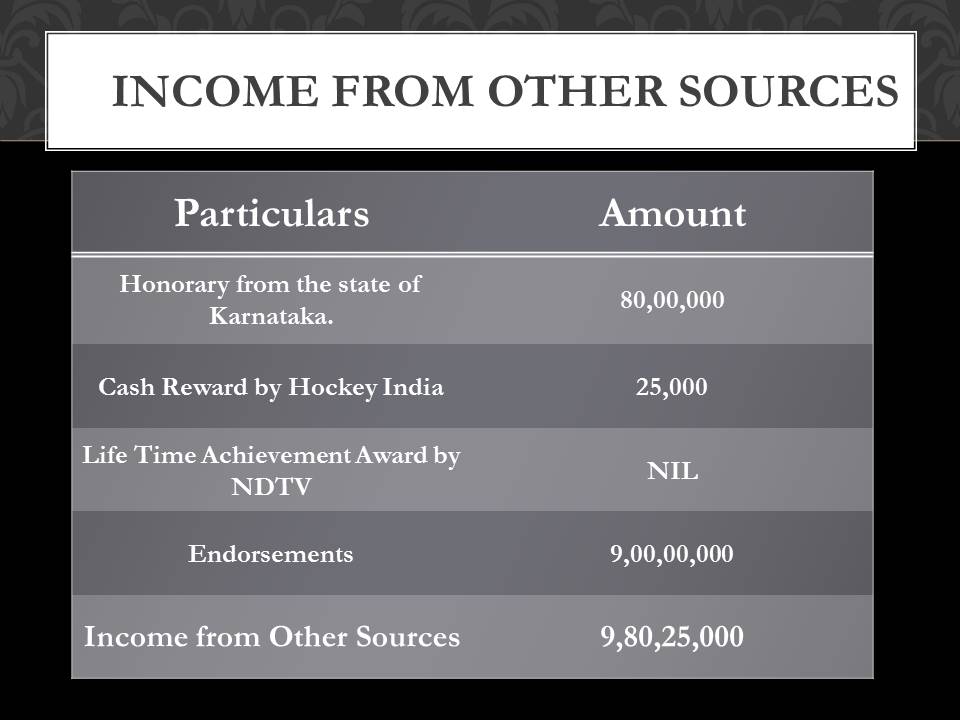

Slide 25 – Income from other sources

| Particulars | Amount |

| Honorary from the state of Karnataka. | 80,00,000 |

| Cash Reward by Hockey India | 25,000 |

| Life Time Achievement Award by NDTV | NIL |

| Endorsements | 9,00,00,000 |

| Income from Other Sources | 9,80,25,000 |

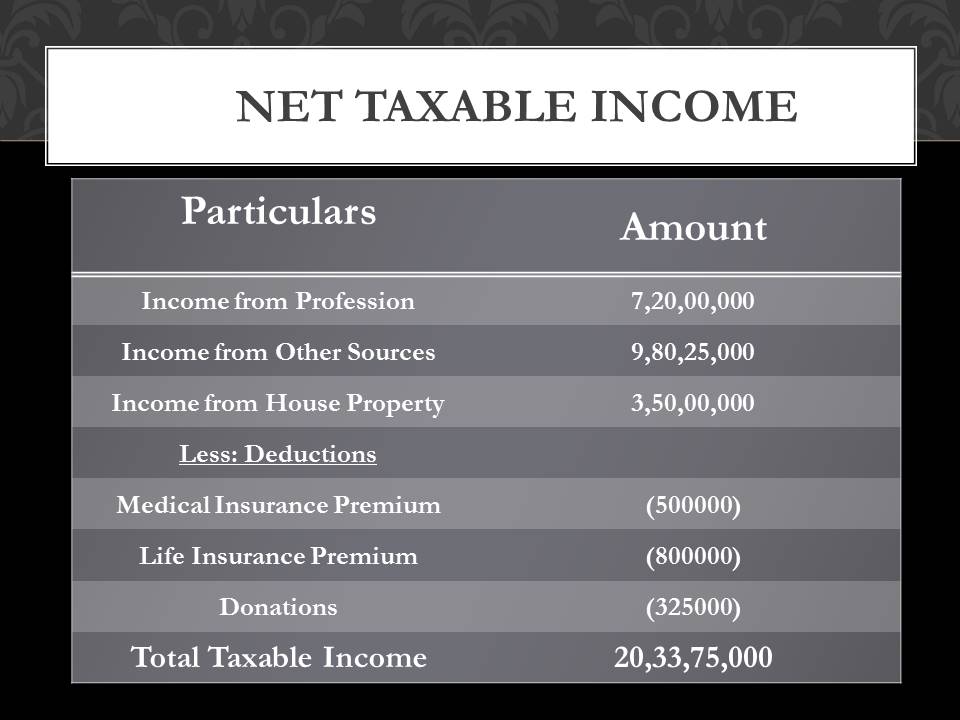

Slide 26 – Net Taxable Income

| Particulars | Amount |

| Income from Profession | 7,20,00,000 |

| Income from Other Sources | 9,80,25,000 |

| Income from House Property | 3,50,00,000 |

| Less: Deductions | |

| Medical Insurance Premium | (500000) |

| Life Insurance Premium | (800000) |

| Donations | (325000) |

| Total Taxable Income | 20,33,75,000 |

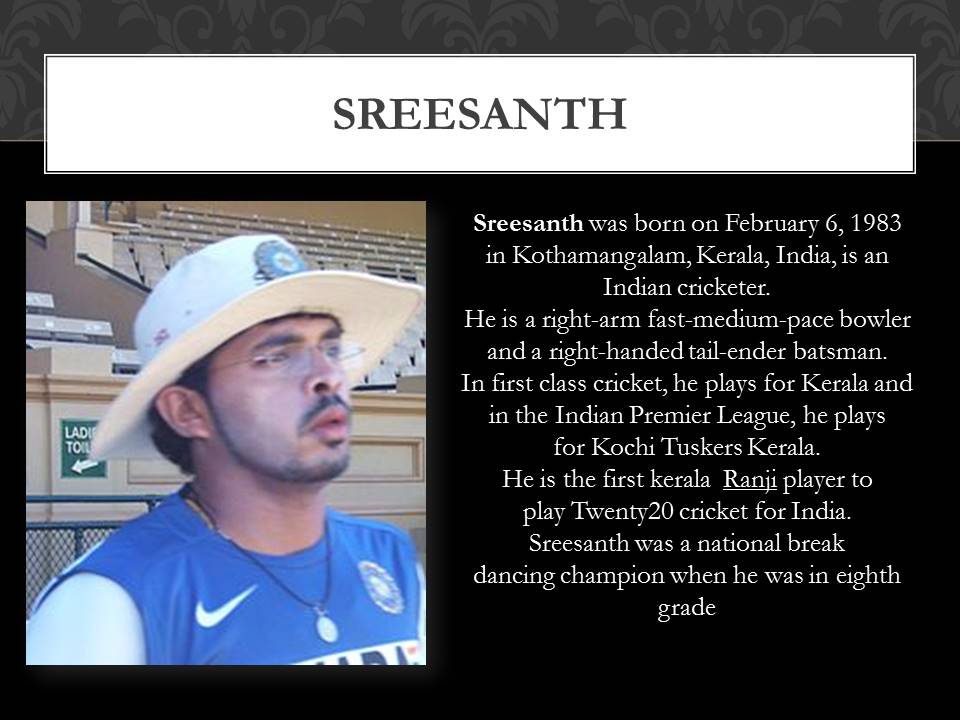

Slide 27 – About Sreeshant

Sreesanth was born on February 6, 1983 in Kothamangalam, Kerala, India, is an Indian cricketer.

He is a right-arm fast-medium-pace bowler and a right-handed tail-ender batsman.

In first class cricket, he plays for Kerala and in the Indian Premier League, he plays for Kochi Tuskers Kerala.

He is the first kerala Ranji player to play Twenty20 cricket for India.

Sreesanth was a national break dancing champion when he was in eighth grade

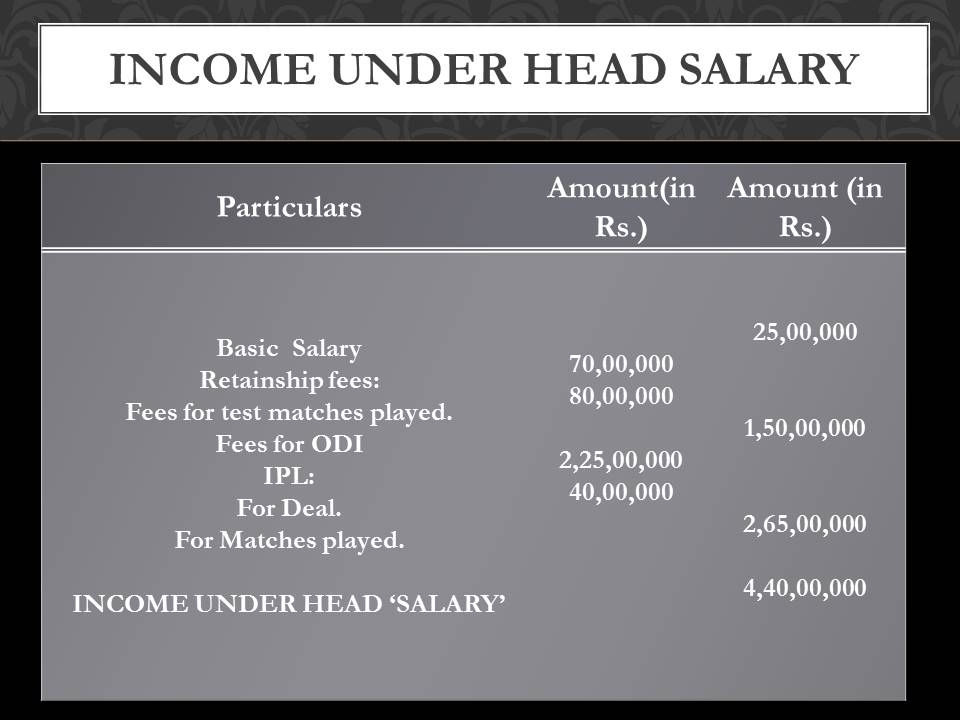

Slide 28 – Income under the head salary

| Particulars | Amount(in Rs.) | Amount (in Rs.) |

| Basic Salary

Retainship fees: Fees for test matches played. Fees for ODI IPL: For Deal. For Matches played. INCOME UNDER HEAD ‘SALARY’ |

70,00,000

80,00,000 2,25,00,000 40,00,000 |

25,00,000

1,50,00,000 2,65,00,000 4,40,00,000 |

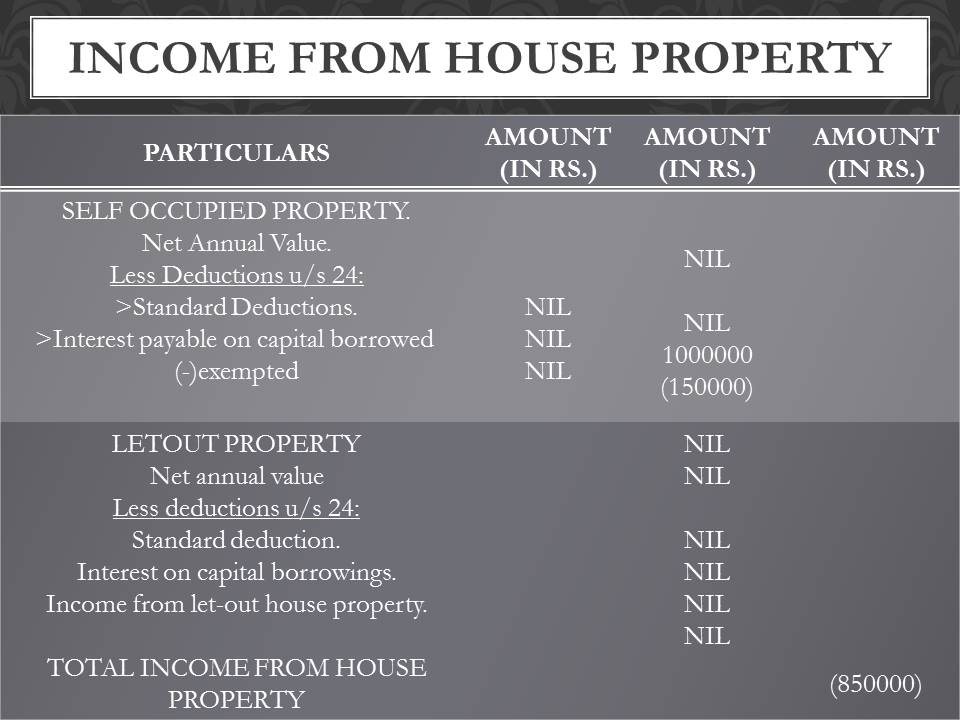

Slide 29 – Income from house property

| PARTICULARS | AMOUNT (IN RS.) | AMOUNT

(IN RS.) |

AMOUNT

(IN RS.) |

| SELF OCCUPIED PROPERTY.

Net Annual Value. Less Deductions u/s 24: >Standard Deductions. >Interest payable on capital borrowed (-)exempted |

NIL

NIL NIL |

NIL NIL 1000000 (150000) |

|

| LETOUT PROPERTY

Net annual value Less deductions u/s 24: Standard deduction. Interest on capital borrowings. Income from let-out house property. TOTAL INCOME FROM HOUSE PROPERTY |

NIL

NIL NIL NIL NIL NIL |

(850000) |

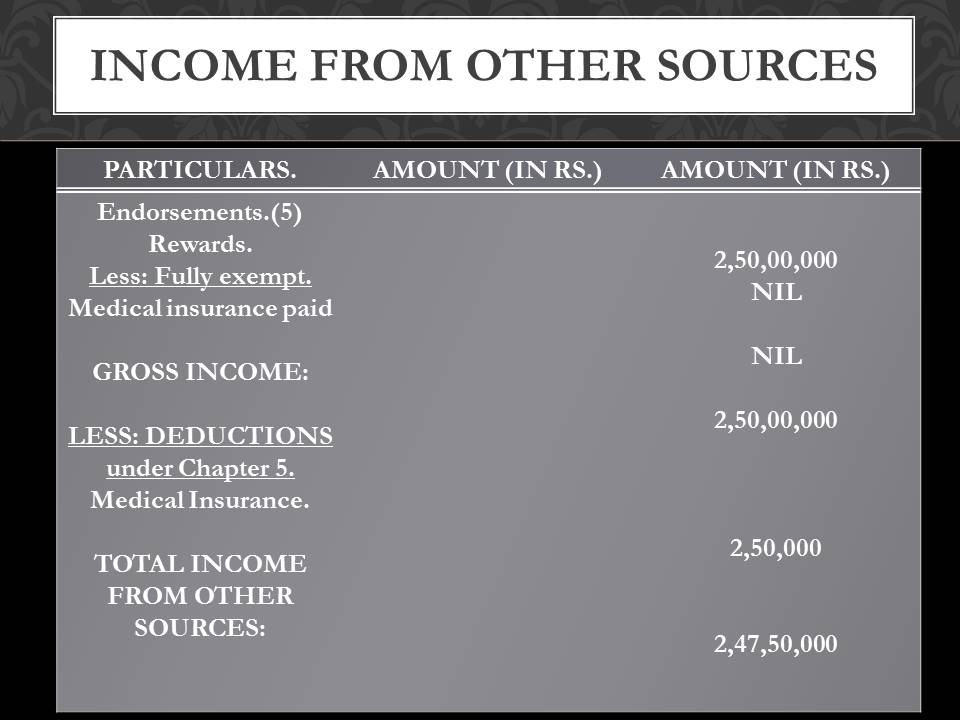

Slide 30 – Income from other sources

| PARTICULARS. | AMOUNT (IN RS.) |

| Endorsements.(5)

Rewards. Less: Fully exempt. Medical insurance paid GROSS INCOME: LESS: DEDUCTIONS under Chapter 5. Medical Insurance. TOTAL INCOME FROM OTHER SOURCES: |

2,50,00,000

NIL NIL 2,50,00,000 2,50,000 2,47,50,000 |

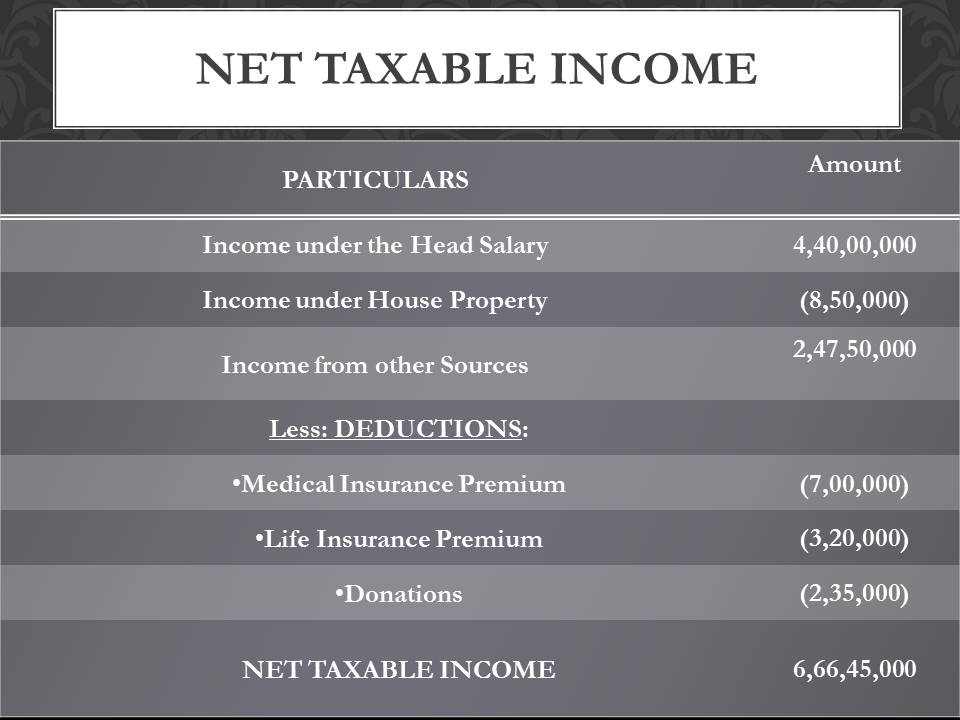

Slide 31 – Net Taxable Income

| PARTICULARS | Amount |

| Income under the Head Salary | 4,40,00,000 |

| Income under House Property | (8,50,000) |

| Income from other Sources | 2,47,50,000 |

| Less: DEDUCTIONS: | |

| •Medical Insurance Premium | (7,00,000) |

| •Life Insurance Premium | (3,20,000) |

| •Donations | (2,35,000) |

| NET TAXABLE INCOME | 6,66,45,000 |

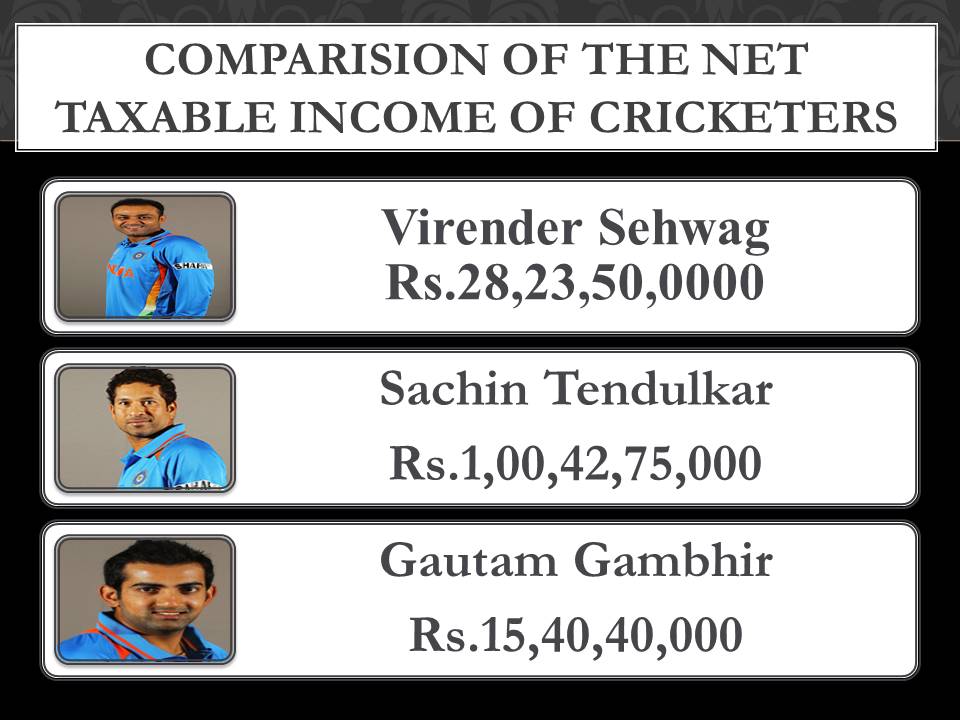

Slide 32 – Comparision Of the net taxable income of cricketers

- Virender Sehwag – Rs.28,23,50,0000

- Sachin Tendulkar – Rs.1,00,42,75,000

- Gautam Gambhir – Rs.15,40,40,000

Slide 33 – Comparision Of the net taxable income of cricketers

- Rahul Dravid – Rs. 20,50,25,000

- Sreeshant – Rs. 20,50,25,000

- V.V.S. Laxman – Rs. 17,85,00,00