All businesses rely on different sources of finance to acquire funds for their business. The money which is required to run business functions is known as business funds. A business can only run smoothly when they have sufficient funds, without sufficient funds they cannot function properly.

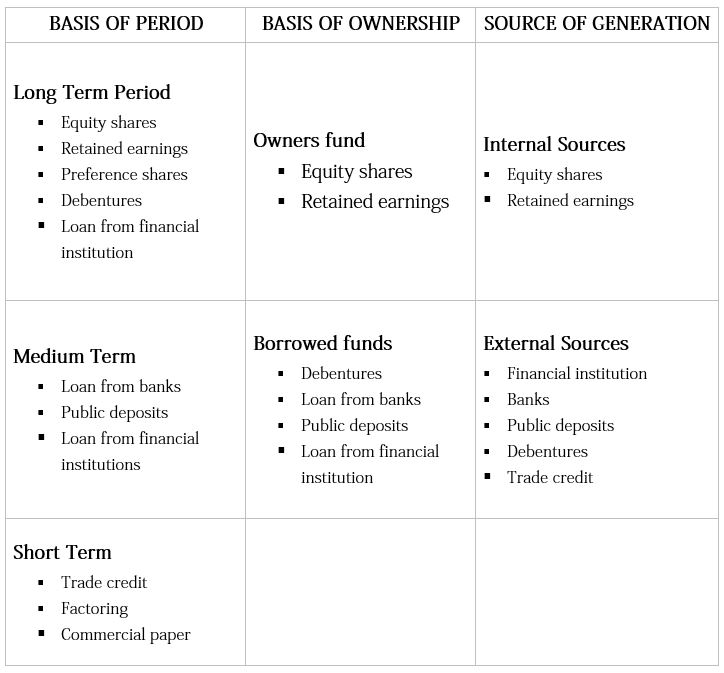

Funds are required continuously in business and companies raise funds through various sources of finance. These sources of finance can be classified on the basis of time, ownership and control, and their sources of generation.

Deciding the correct sources of finance is one of the most difficult task for those who are deciding to start a new business or already have an established business. So every organization should consider all aspects regarding different sources of finance before deciding from which source they want to raise funds.

Classification of Sources of Finance or Sources of Funds

Sources of Finance on the Basis of Time Period

1. Long-Term Sources

These are the sources of finance that fulfill the financial requirements of the business for a longer period which is more than 5 years. It includes debenture, equity shares, preference shares, loans, etc. This finance is generally used for the procurement of fixed assets like plant, equipment, machinery, etc.

Also Read: Long Term Sources of Finance

2. Medium-Term Sources

These are the sources that are required for a period of more than one year but less than five years. Examples of these sources are a loan from banks, public deposits, a loan from a financial institution, etc.

3. Short-Term Sources

These are the funds that are required for less than a year. Few examples of these sources are trade credit, banks, commercial paper, etc.

Sources of Finance on the Basis of Ownership

1. Owner’s fund

These are those funds that are raised by the owner of the business. It can be raised by the sole person or the partners or by the shareholders. This capital remains invested in the business for a longer period of time. Equity shares and retained earnings are two main sources of the owner’s fund.

2. Borrowed fund

This is the most commonly used source of funds. Borrowed funds provide funds for a specific period, on certain terms and conditions. It has to be repaid after the expiry of the period with interest. These funds are raised from loans and borrowings. It includes loans from commercial banks, issue of debentures, loans from financial institutions, public deposits, and trade credit.

Sources of Finance on the Basis of Sources of Generation

1. Internal Sources

Internal sources of finance are those funds that are within an organization. Basically, these sources fulfill the short and limited needs of a business. Examples of these sources are equity share capital and retained earnings.

Also Read: Internal Sources of Finance

2. External Sources

These refer to those sources which involve raising funds outside of an organization. It is useful when a large amount of money is needed. Some examples of it are banks, financial institutions, debentures, public deposits, preference shares, etc.

Hello There. I discovered your blog using msn. This is an extremely well written article. I’ll be sure to bookmark it and come back to learn extra of your useful info. Thank you for the post. I will definitely comeback.