Variance analysis is used to observe how well a business is performing and how close actual costs are to the standard cost.

An accounting variance is defined as the difference between actual cost and standard cost. Variance analysis uses the standard versus actual amount to judge the performance. The analysis includes an explanation of the variance as well as evaluation as to why a variance may have occurred. The purpose of this detailed information is to assist the management in determining what may have gone right or wrong and to help in future decision making.

While interpreting variances, one has to understand that variance may be favorable or unfavorable. A variance is favorable when the actual results are better than standard results. This means costs were less than the standard or planned amount. An unfavorable variance also known as adverse variance occurs when actual costs are higher than standard. Consistently creating an adverse variance might result in a manager being punished or losing the job.

Decisions based on Variance Analysis

If the market price of material has gone up, it is uncontrollable or if electricity or power rates are increased by the government, a business manager cannot be responsible for the adverse variance that will result from such a situation. Similarly, if the price of the material comes down in the market, it will be creating a favorable material price variance but a manager cannot be rewarded for such a variance because it is not because of his actions.

Therefore before interpreting the variance, one has to see the exact cause of such a variance and whether it is controllable or uncontrollable. Managers can be held responsible only for controllable variance i.e. those variances which show their performance and efficiency.

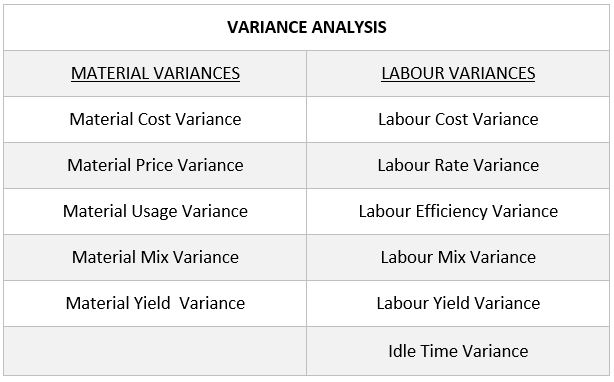

Types of Variances in Variance Analysis

Material Variance

Under variance analysis, the following are the variances that constitute material variance –

Material Cost Variance

Material cost variance is the difference between the actual cost of direct material used and the standard cost of direct materials specified for the output achieved. This variance results from differences between quantities consumed and quantities of materials allowed for production and from differences between prices paid and prices predetermined.

This can be calculated by using the following formula –

Material Cost Variance = Standard Cost – Actual Cost

Material Cost Variance = (Standard Quantity X Standard Price) – (Actual Quantity X Actual Price)

Material Usage Variance

The material usage variance results when actual quantities of raw materials used in production differ from standard quantities. A material usage variance is favorable when the total actual quantity of direct materials used is less than the total standard quantity allowed for the actual output.

This can be calculated by the following formula –

Material Usage Variance = (Standard Quantity – Actual Quantity) X Standard Price

The material usage variance can be separated into material mix variance and material yield variance

Material Mix Variance

Material mix variance is that portion of the materials quantity variance which is due to the difference between the actual composition of a mixture and the standard mixture. A mix variance will result when materials are not actually placed into production in the same ratio as the standard formula.

It can be computed using the following formula –

Material Mix Variance = (Revised Quantity – Actual Quantity) X Standard Price

Revised Quantity means revised standard quantity

RQ = (Standard Quantity of Individual Item X Total Actual Quantity)/ Total standard quantity

Material Yield Variance

Material yield variance explains the remaining portion of the total materials quantity variance. It is the portion of material usage variance which is due to the difference between the actual yield obtained and standard yield specified.

Material yield variance occurs when the output of the final product does not correspond with the output that could have been obtained by using the actual inputs. The total of material mix variance and material yield variance equals to material usage variance.

The formula for computing material yield variance is –

Material Yield Variance = (Actual Yield – Standard Yield Specified) X Standard Cost per unit

Material Price Variance

A Material variance price occurs when raw materials are purchased at a price different from the standard price. It is that portion of the direct materials which is due to the difference between the actual price paid and standard price specified and cost variance multiplied by the actual quantity.

Material price is unfavorable when the actual price exceeds the predetermined standard price. It is advisable that material price variance should be calculated for materials purchased rather than the material used.

Following is the formula for the computation for material price variance-

Material Price Variance = (Standard Price – Actual Price) X Actual Quantity

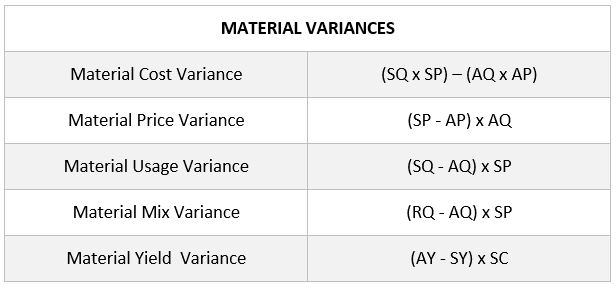

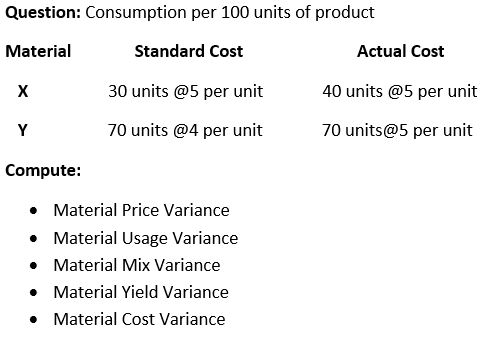

Computation of Material Variances

SQ = Standard Quantity

AQ = Actual Quantity

SP = Standard Price

AP = Actual Price

AY = Actual Yield

SY = Standard Yield

RQ = Revised Standard Quantity

SC = Standard Cost Per Unit

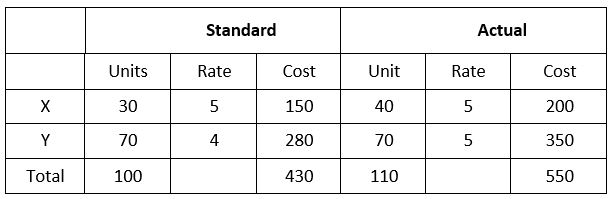

Answer

Revised Standard Quantity (RQ)

X = (110 X 30)/100 = 33

Y = (110 X 70)/100 = 77

Calculation of variances

Material Price Variance = (SP – AP) X AQ

X = (5 – 5) X 40 = NIL

Y = (4 – 5) X 70 = 70

MPV = ₹ 70

Material Usage Variance = (SQ – AQ) X SP

X= (30 – 40) X 5 = 50

Y= (70 – 70) X 4 = NIL

MUV = ₹ 50

Material Mix Variance = (RQ – AQ) X SP

X = (33 – 40) X 5 = 35

Y = (77 – 70) X 4= 28

MMV = ₹ 7

Material Yield Variance = (SY – AY) X SC per unit

MYV = (100 – 110) X (430/100) = ₹ 43

Material Cost Variance = SC – AC

MCV = (430 – 550) = ₹ 120

Labour Variance

Labour variances arise when actual labour cost is different from standard cost. In the analysis of labour costs, the emphasis is on labour rates and labour hours.

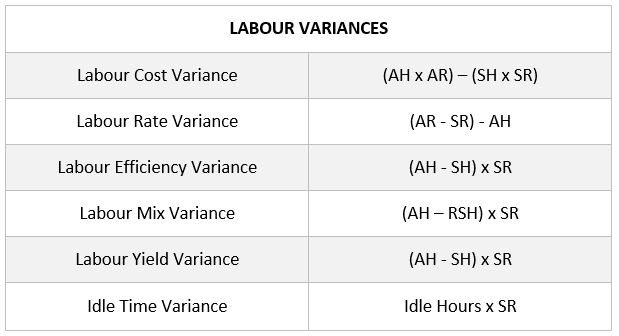

Under variance analysis, Labour variances constitute the following –

Labour Cost Variance

Labour cost variance denotes the difference between the actual direct wages paid and the standard direct wages specified for the output achieved.

Following is the formula for computing labour cost variance-

Labour Cost Variance = Standard Cost – Actual Cost

Labour Cost Variance = (Actual Hours X Actual Rate) – (Standard Hours X Standard Rate)

Labour Efficiency Variance

Labour efficiency variance is also computed the same as material efficiency variance. Labour efficiency variance occurs when labour operations are more efficient or less efficient than standard performance.

Following is the formula for computing labour efficiency variance

Labour Efficiency Variance = (Actual Hours – Standard Hours) X Standard Rate per hour

Labour efficiency or usage variance can further be divided into two types

Labour Mix Variance

Manufacturing or completing a job requires different types or grades of workers and production will be completed if labour is mixed according to standard proportion. Labour mix variance is also calculated as the material mix variance.

Following is the formula for computing labour mix variance-

Labour Mix Variance = (Actual Labour Hours – Revised Standard Labour Hours) X Standard Rate per hour

Labour Yield Variance

The final product cost contains not only material costs but also labour cost. Therefore, gain or loss should take into account labour yield variance also.

Following is the formula for computing labour yield variance

Labour Yield Variance = (Actual Hours – Standard Hours) X Average Standard Labour Rate Per Unit Of Output

Labour Yield Variance = (Actual Loss Hours – Standard Loss hours) X Average Standard Labour Rate per unit of output

Labour Rate Variance

Labour rate variance is computed in the same manner as materials price variance. When actual direct labour hour rates differ from standard rates, the result is labour rate variance.

Following is the formula for computing labour rate variance –

Labour Rate Variance = (Actual Rate – Standard Rate) X Actual Hours

Idle Time Variance

Idle Time Variance forms a portion of wages efficiency variance. It is represented by the standard cost of the actual hours for which the workers remain idle due to abnormal circumstances.

Idle Time Variance = Idle Hours X Standard Rate

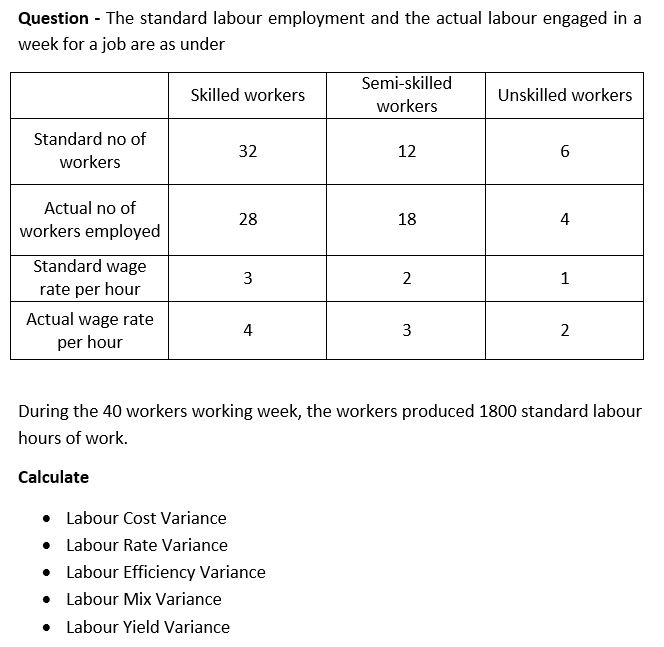

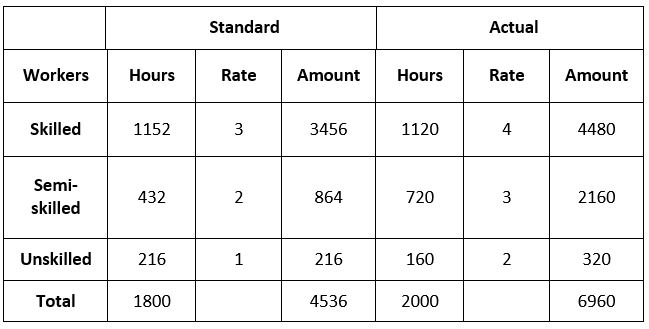

Computation of Labour Variances

Answer

Labour Cost Variance= (Standard Coast- Actual Cost) = 4536 – 6960 = 2424

Labour Rate Variance = (Standard Rate – Actual Rate) X Actual Hour

Skilled = (3 – 4) X 1120 = 1120

Semi-Skilled = (2 – 3) X 720 = 720

Unskilled = (1 – 2) X 160 = 160

LRV = 2000

Labour Efficiency Variance = (Standard Hours for Actual Output – Actual Hour) X Standard Rate

Skilled = (1152 – 1120) X 3 = 96

Semi-Skilled = (432-720) X 2 = 576

Unskilled = (216 – 160) X 1 = 56

LEV = 424

Labour Mix Variance = (Revised Standard Hours – Actual Hours) X Standard Rate

Skilled = (1280 – 1120) X 3 = 480

Semi Skilled = (480 – 720) X 2= 480

Unskilled = (240 – 160) X 1 =80

LMV = 80

Labour Yield Variance = (Standard Hours – Revised Standard Hours) X Standard Rate

Skilled = (1152 – 1280) X 3 = 3784

Semi-Skilled = (432 – 480) X 2 = 96

Unskilled = (216-240) X 1 = 24 LYV = 504

Also Read: CVP Analysis, Marginal Costing, Make or Buy Decisions, Standard Costing

Thanks for sharing your thoughts about %meta_keyword%. Regards