Meaning of financial statement analysis

The term financial statement analysis and interpretation refer to the process of determining the financial strength and weaknesses of the firm by establishing a strategic relationship between the items of the balance sheet profit and loss account and other operative data.

According to John N. Nyer “Financial statements provide a summary of the accounting of a business enterprise, the balance-sheet reflecting the assets, liabilities, and capital as on a certain data and the income statement showing the results of operations during a certain period.”

Objectives of financial statement analysis

Following are some of the main objectives of financial statement analysis –

- The financial statement reviews the trend of past sales, profitability, cash flows, return on investment, debt-equity structure, and operating expenses, etc. It reviews the performance of the company over the past periods.

- It examines the current profitability and operational efficiency of the enterprise so that the financial health of the company can be determined. It helps in finding out the earning capacity and operating performance of the company.

- Financial analysis helps the top management in reviewing the investment alternatives for judging the earning capacity of the company. With the help of financial analysis prediction of bankruptcy and profitability of the business can be done.

- Financial analysis helps the financial institutions, loan agencies, and banks to decide whether a loan can be given to them or not.

- It helps the organization in ascertaining the earning capacity in the future period.

Procedure for analysis and interpretation of financial statements

The following are the steps that are required for the analysis and interpretation of financial statements.

- The first step is to decide the objective of preparing a financial statement analysis. Figure out why it is to be prepared and on the basis of the objective, techniques of analysis will be selected.

- The second step is to ascertain all the assumptions, principles, practices, etc. that are to be followed while preparing financial statements.

- The third step is to gather all the additional information in order to prepare financial statements.

- The fourth step is to present all the data collected in a logical sequence by rearranging and readjusting the different items.

- The fifth step is to analyze the data for preparing comparative statements, computation of ratios, ascertaining averages, and estimating trends.

- The sixth step is the interpretation of the facts gathered from the analysis by considering the general state of the market and economy.

- The last step is to present the data and information in a suitable form.

Techniques / Types of financial statement analysis

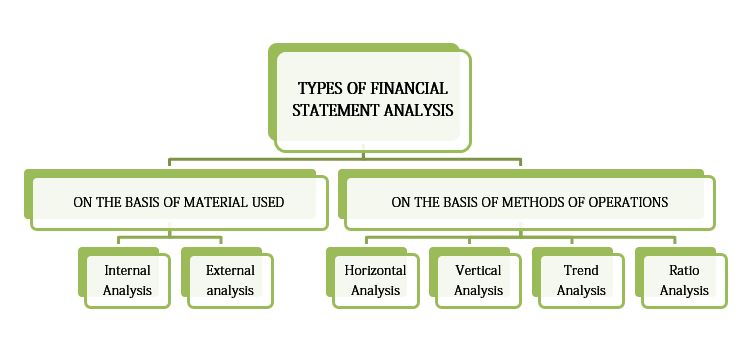

Analysis of financial statement can be broadly classified into two categories:-

On the basis of material used – based on the material used financial statement can be classified into two types:-

- External Analysis

External analysis is basically done by the outsiders of the business concern but they are indirectly involved in business concerns such as investors, creditors, government, etc. This analysis is very much useful to understand the financial and operational position of the business concern.

- Internal Analysis

This analysis is used to understand the operational performances of each and every department and unit of the business concern. The internal analysis helps to take decisions regarding achieving the goals of the business.

On the basis of the method of operation – based on the method of operation financial statement can be classified into two types-

- Horizontal analysis

This analysis is also called Dynamic analysis. Under this current year figures are compared with the base year (100) or previous year and on the basis of that decisions are taken. Financial statements present comparative information for at least two years and calculate the amount and percentage changes from the previous year to the current year.

- Trend Analysis

It involves the calculation of percentage changes in financial statement items for a number of successive years. It is an extension of horizontal analysis. First, a value of 100 is assigned to the items in the financial statement in the base year and then express the amounts in the following years as a percentage of the base year value.

- Vertical analysis

This analysis is also called static analysis because this analysis helps to determine the relationship between various items that appear in the financial statements. Under this financial statement measures proportional expression of the amount of each item on a financial statement to the statement total. Common size statements are prepared in which the items within each statement are expressed in percentages of some common number that always add up to 100. The items are expressed in the profit and loss account as a percentage to sales and balance sheet items as percentages of the total of shareholders` equity and liabilities.

- Ratio Analysis

Ratio Analysis involves establishing a relevant financial relationship between different components of financial statements. The profitability ratios, liquidity ratios, solvency ratios, and capital market ratios are calculated to aid in financial decision making.

Importance of financial statement analysis

- Holding of shares – Financial statement analysis provides meaningful information to shareholders whether they should continue with the holding of the shares or sell them out.

- Decisions and plans – The management of the company is responsible for taking decisions and making plans for the future, therefore financial statements help them in evaluating a company’s performance and make the right decisions.

- Extension of credit – Creditors of the company also have to decide whether they should extend their loans and demand a higher interest rate or not so they depend on the financial statements to make these decisions.

- Investment decision – Investors of a company also depend on the financial statement as they provide them useful information regarding whether they should invest their capital into a company’s share or not.

- Importance for employees – The financial statement is them the information related to paycheck whether the company can increase their wages or not.

Limitations of financial statement analysis

- Based on past data – The nature of financial statements is historic it is basically based on past data and past data cannot give the exact estimation for the future.

- Reliability – Figures of the financial statement are not fully reliable as they can be manipulated by window dressing, analysis based on those figures will be misleading.

- Different interpretations – Results of the analysis may be interpreted differently by different users.

- Change in accounting methods – When there is a frequent change in accounting policies or methods, the figures of different periods will be different and incomparable. Then the analysis will have little meaning and value.

- Price level changes – Ever-rising inflation erodes the value of money in the present-day economic situation, which reduces the validity of the analysis.